Get W2 Colorado Form

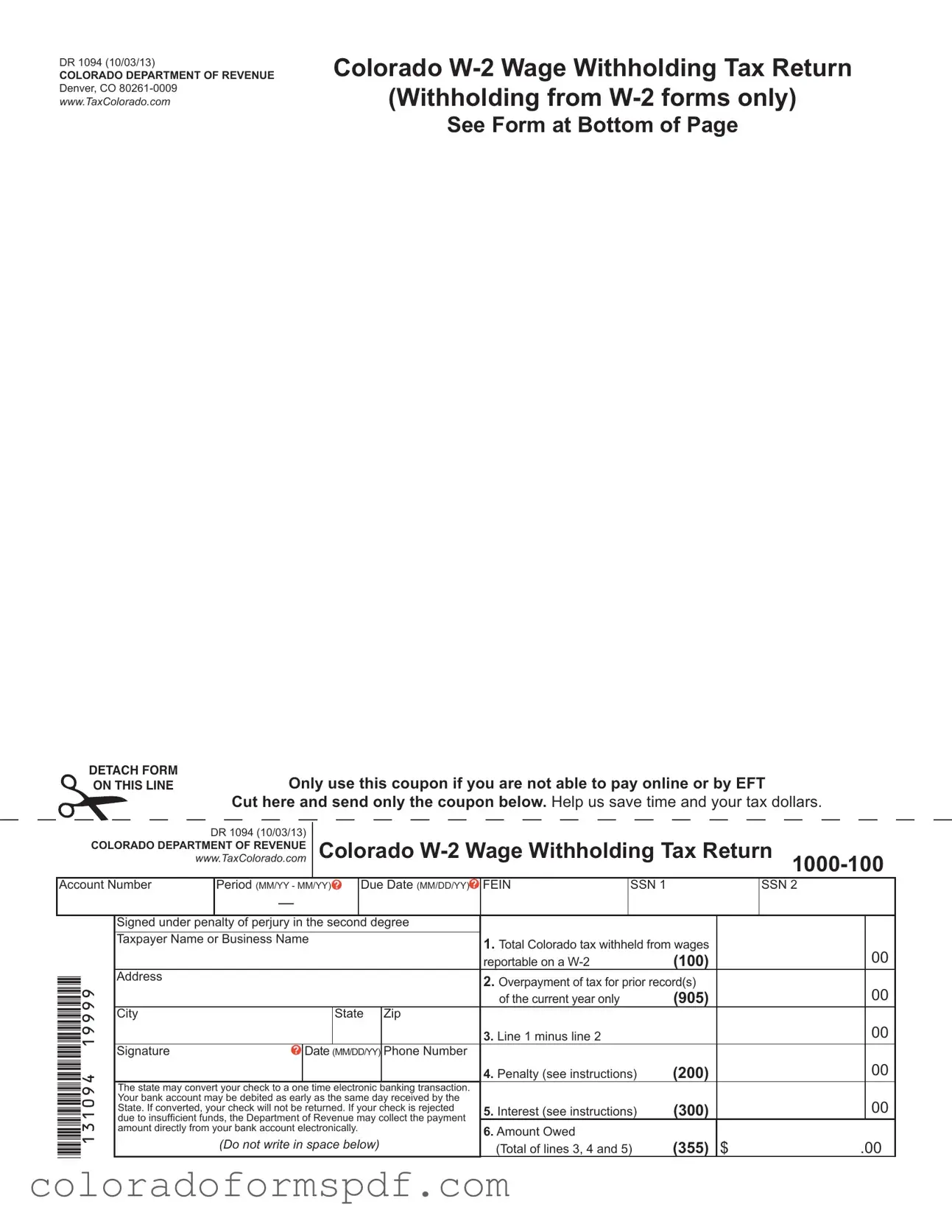

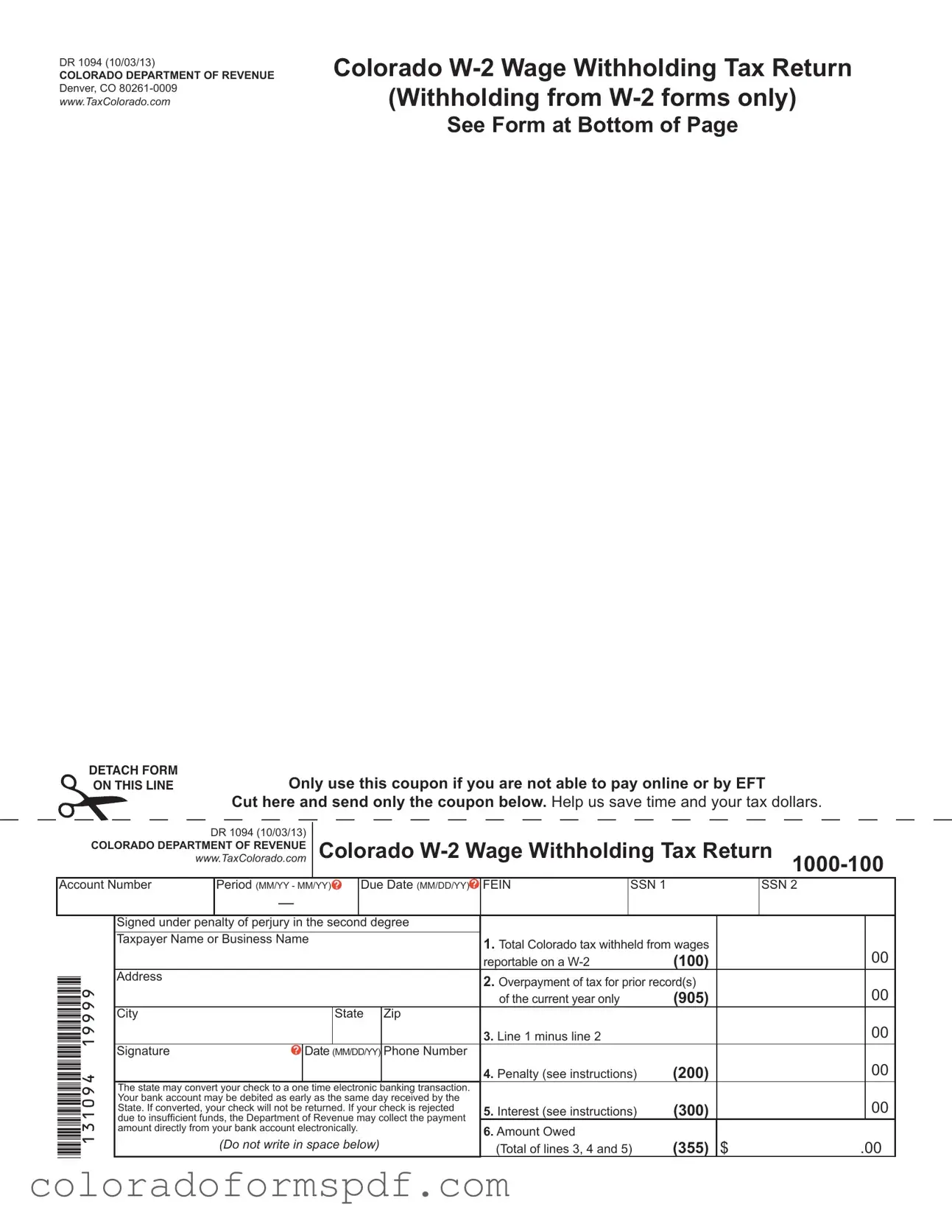

The W-2 Colorado form is a tax return used by employers to report the income taxes withheld from employee wages in Colorado. This form, officially known as the DR 1094, is essential for ensuring compliance with state tax requirements. Employers must accurately complete and submit this form to report the total Colorado tax withheld for the specified filing period.

Get Document Online

Get W2 Colorado Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your W2 Colorado online, then download.