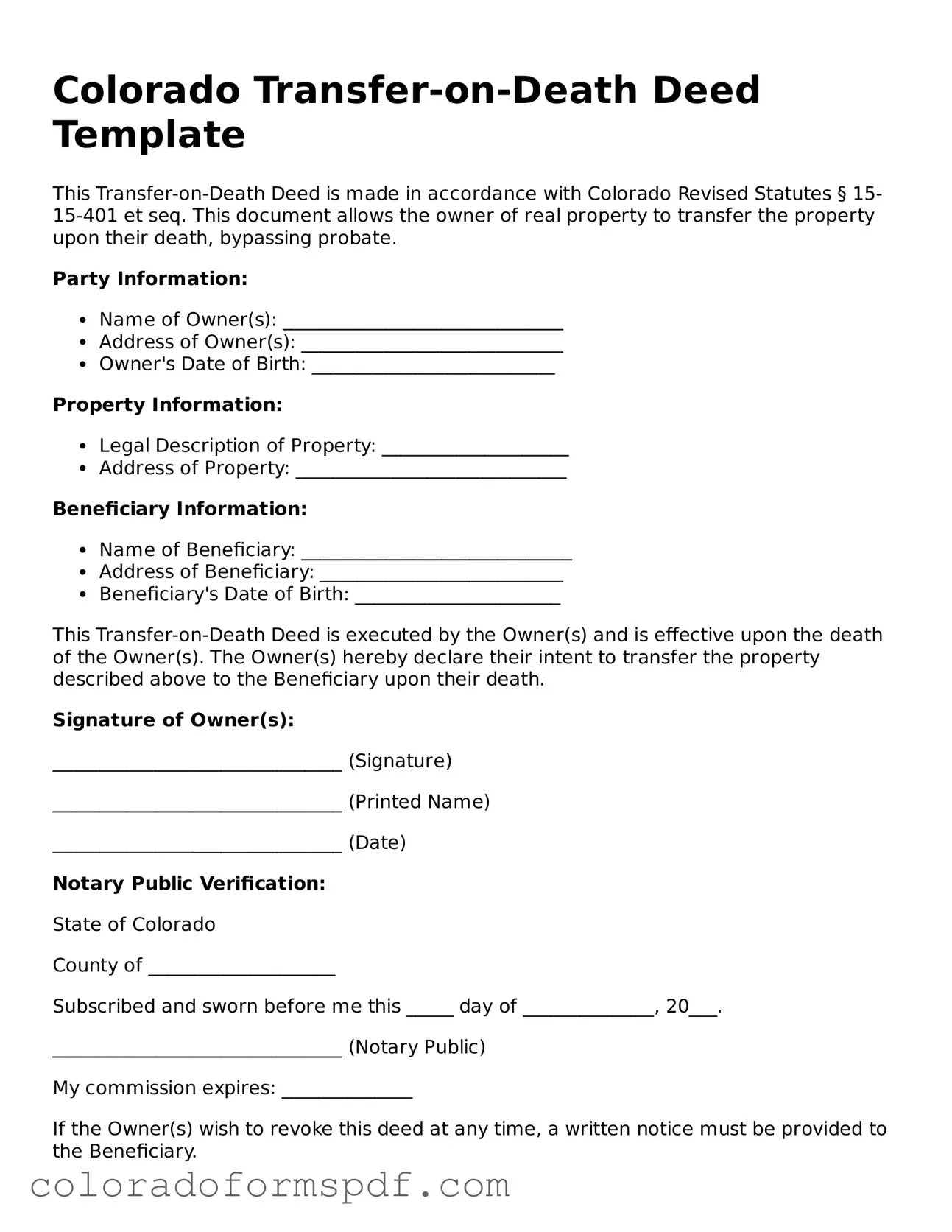

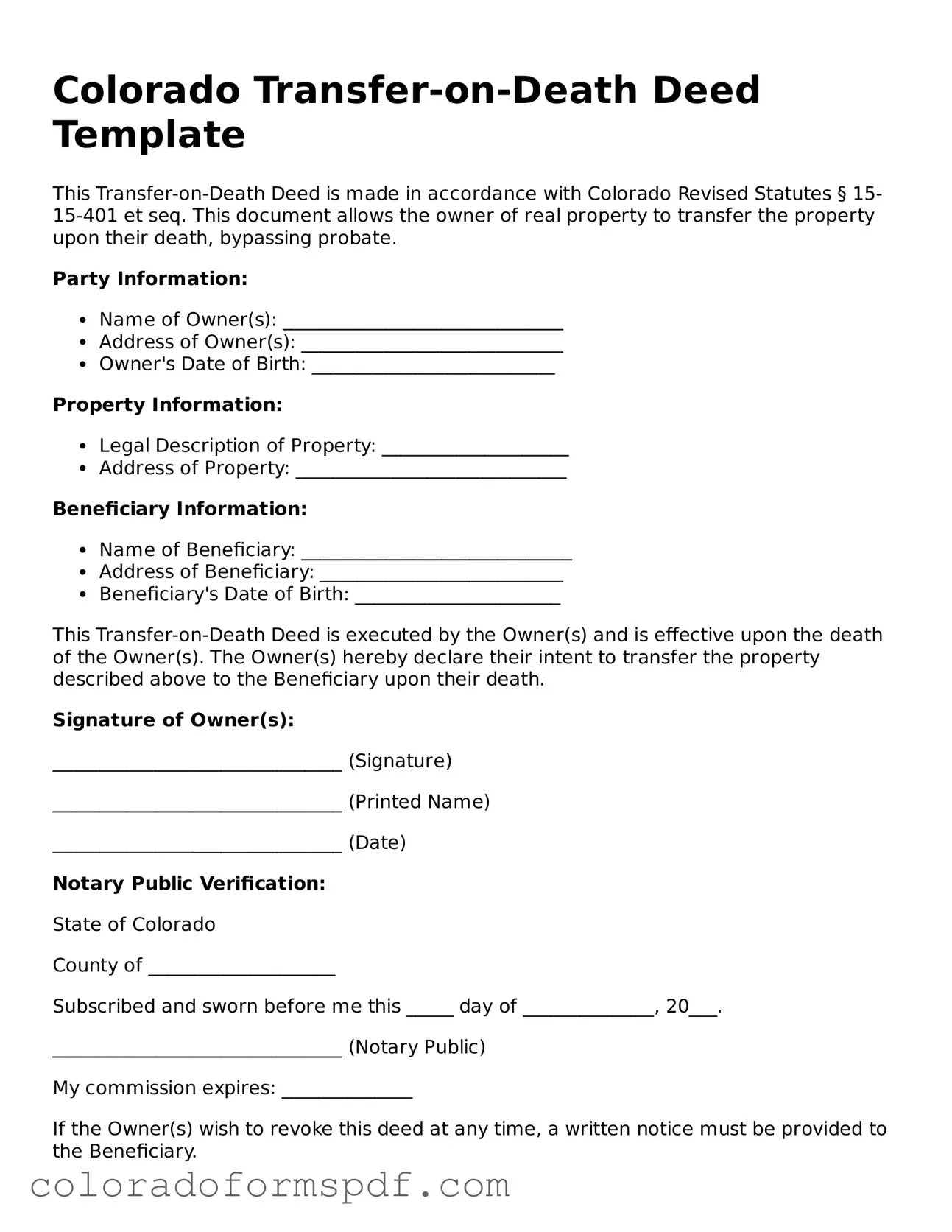

Official Transfer-on-Death Deed Template for Colorado State

The Colorado Transfer-on-Death Deed form is a legal document that allows property owners to transfer their real estate to beneficiaries upon their death without going through probate. This form simplifies the process of passing on property, ensuring that loved ones receive their inheritance quickly and efficiently. Understanding how this deed works can help individuals make informed decisions about their estate planning.

Get Document Online

Official Transfer-on-Death Deed Template for Colorado State

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Transfer-on-Death Deed online, then download.