Official Small Estate Affidavit Template for Colorado State

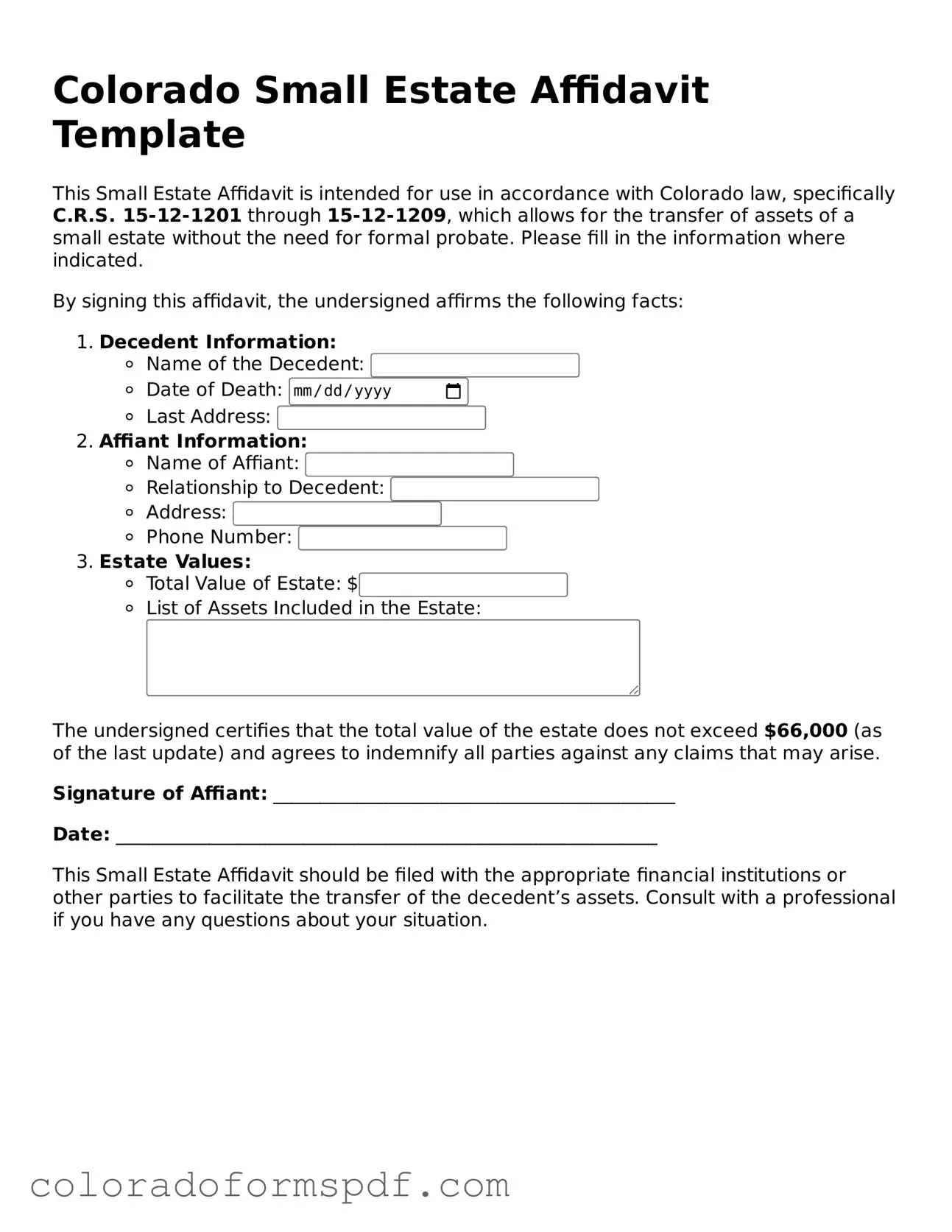

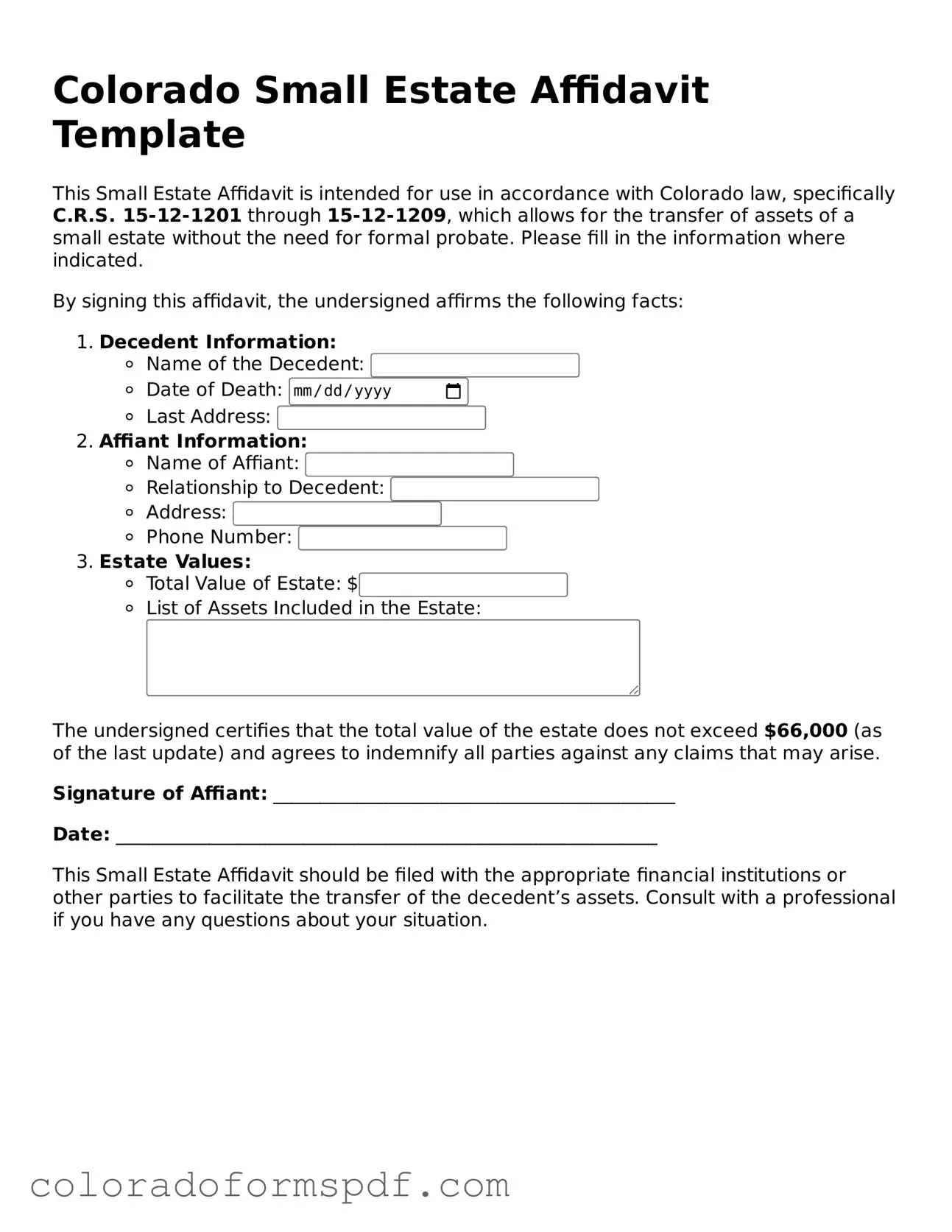

The Colorado Small Estate Affidavit is a legal document that allows individuals to settle the estate of a deceased person without going through the formal probate process. This form is particularly useful for estates that meet specific value thresholds, simplifying the transfer of assets to rightful heirs. By using this affidavit, heirs can efficiently manage and distribute the deceased's property while minimizing legal complexities.

Get Document Online

Official Small Estate Affidavit Template for Colorado State

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Small Estate Affidavit online, then download.