Get Dr 1083 Colorado Form

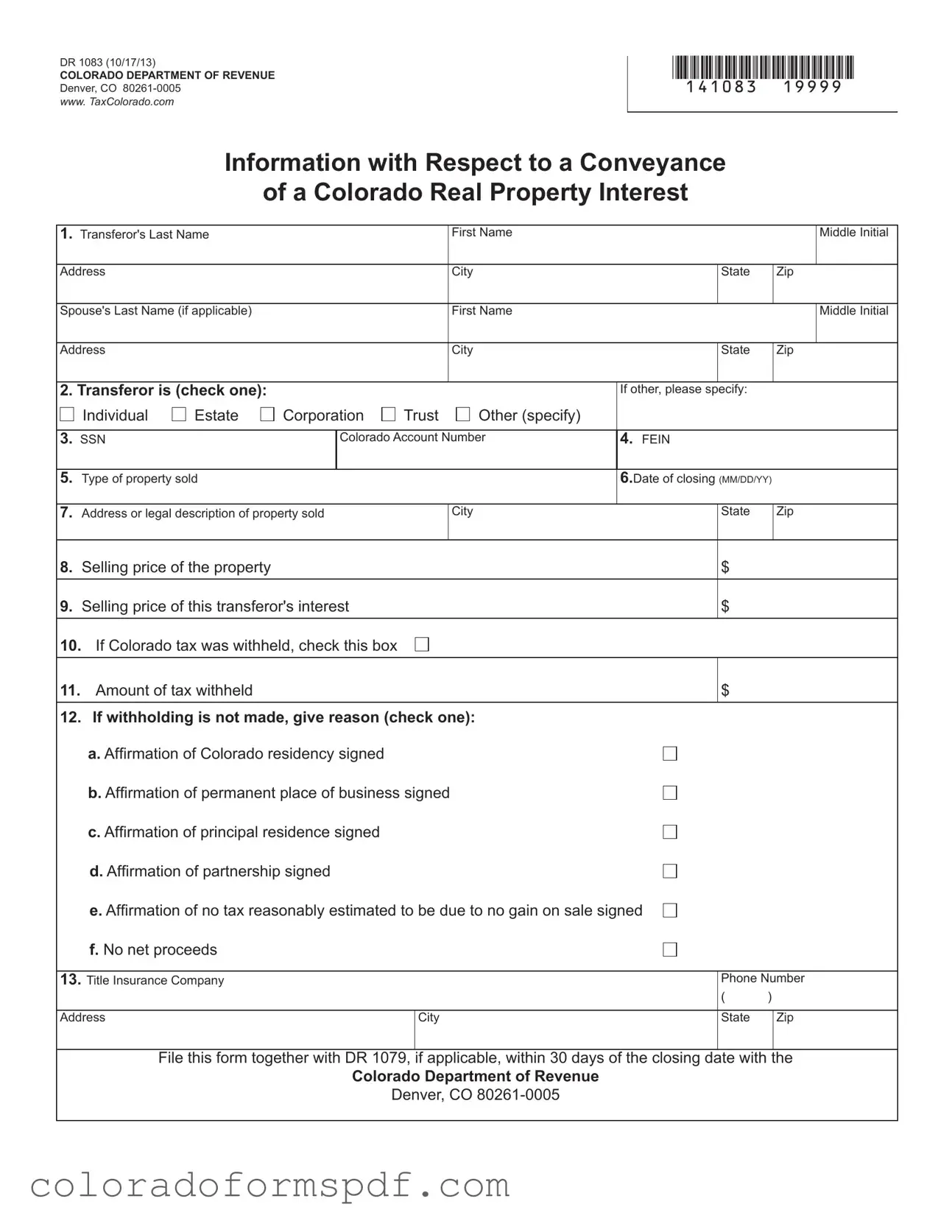

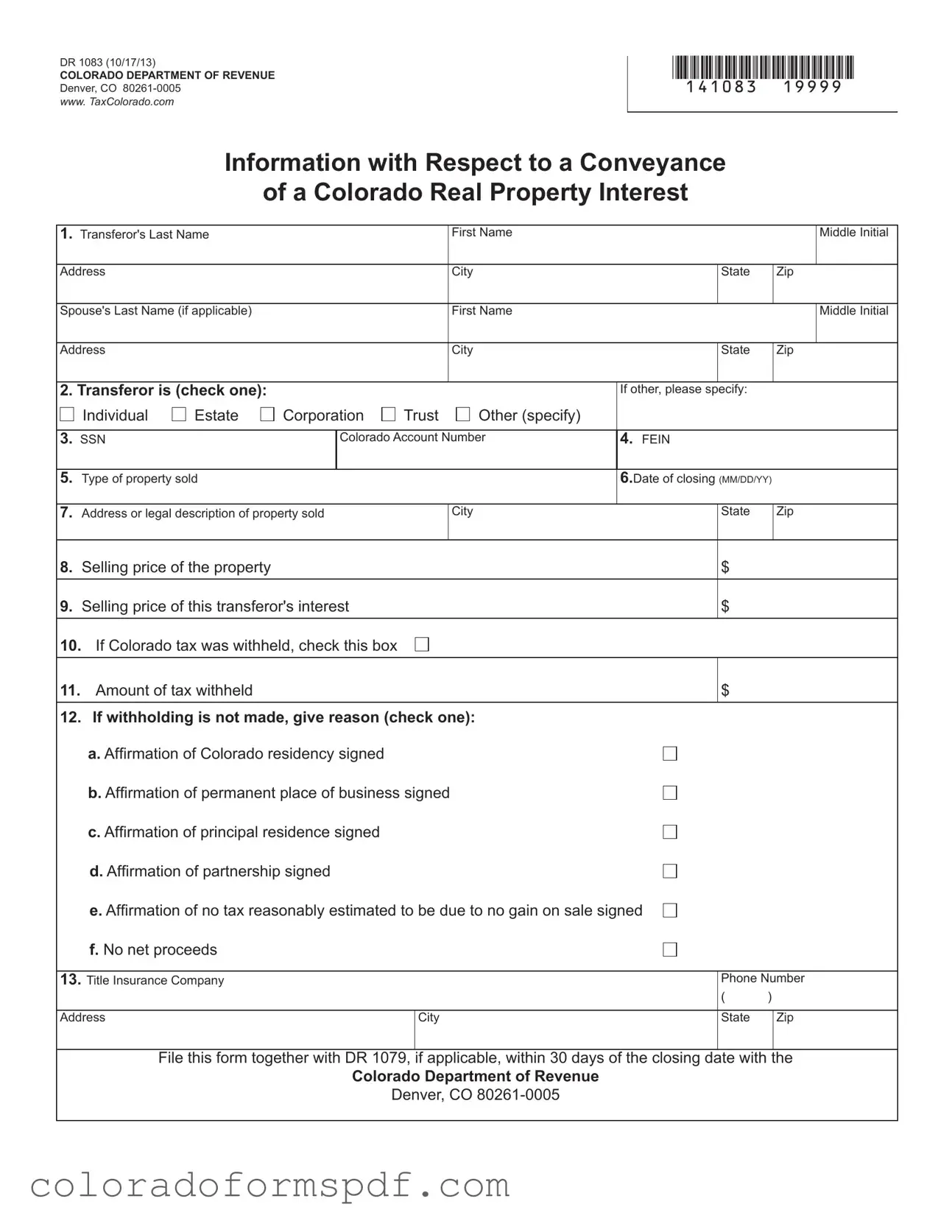

The DR 1083 form is a document required by the Colorado Department of Revenue that provides essential information regarding the conveyance of a real property interest in Colorado. This form must be completed and submitted within 30 days of the closing date when certain conditions are met, particularly when Colorado tax withholding applies. Understanding its requirements is crucial for both transferors and title insurance companies to ensure compliance and avoid penalties.

Get Document Online

Get Dr 1083 Colorado Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Dr 1083 Colorado online, then download.