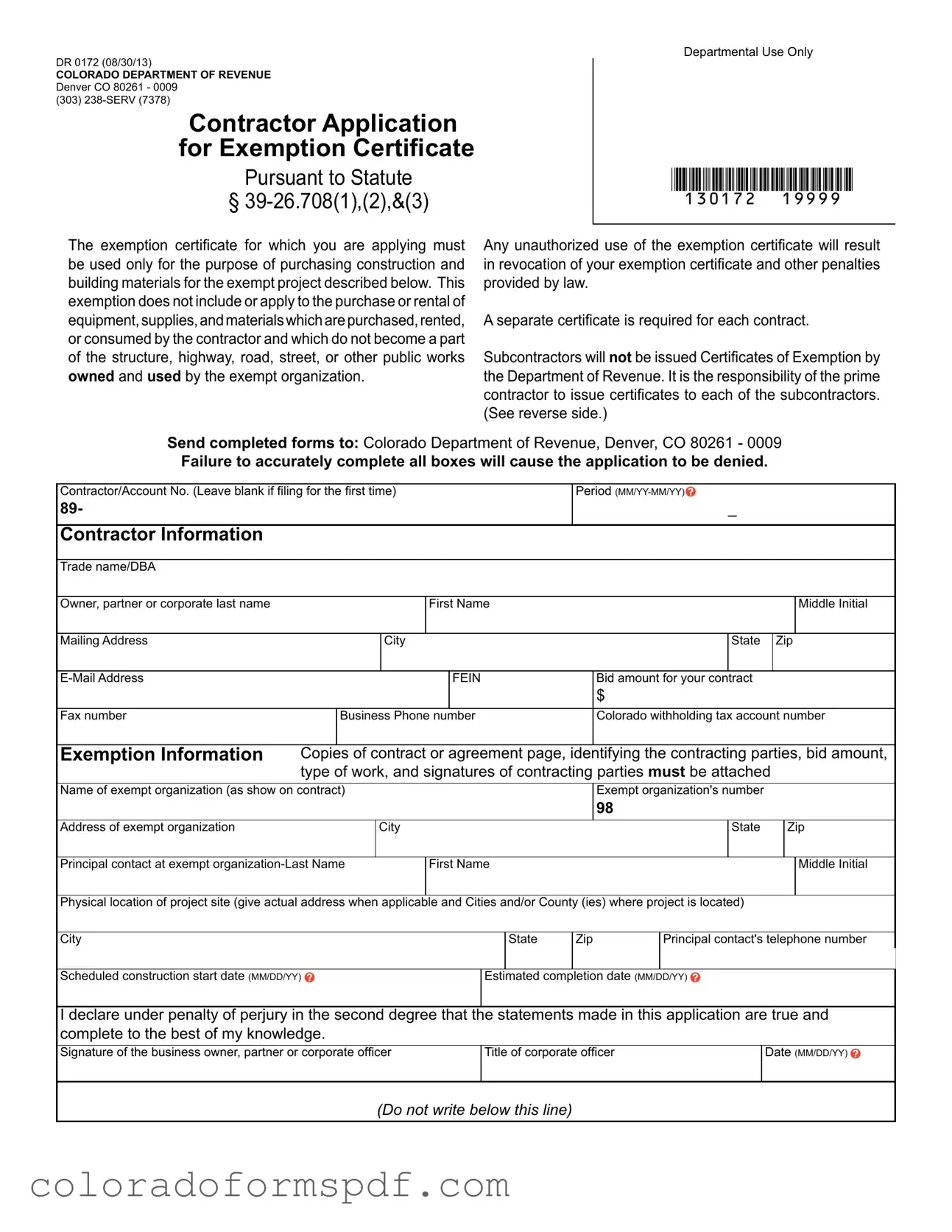

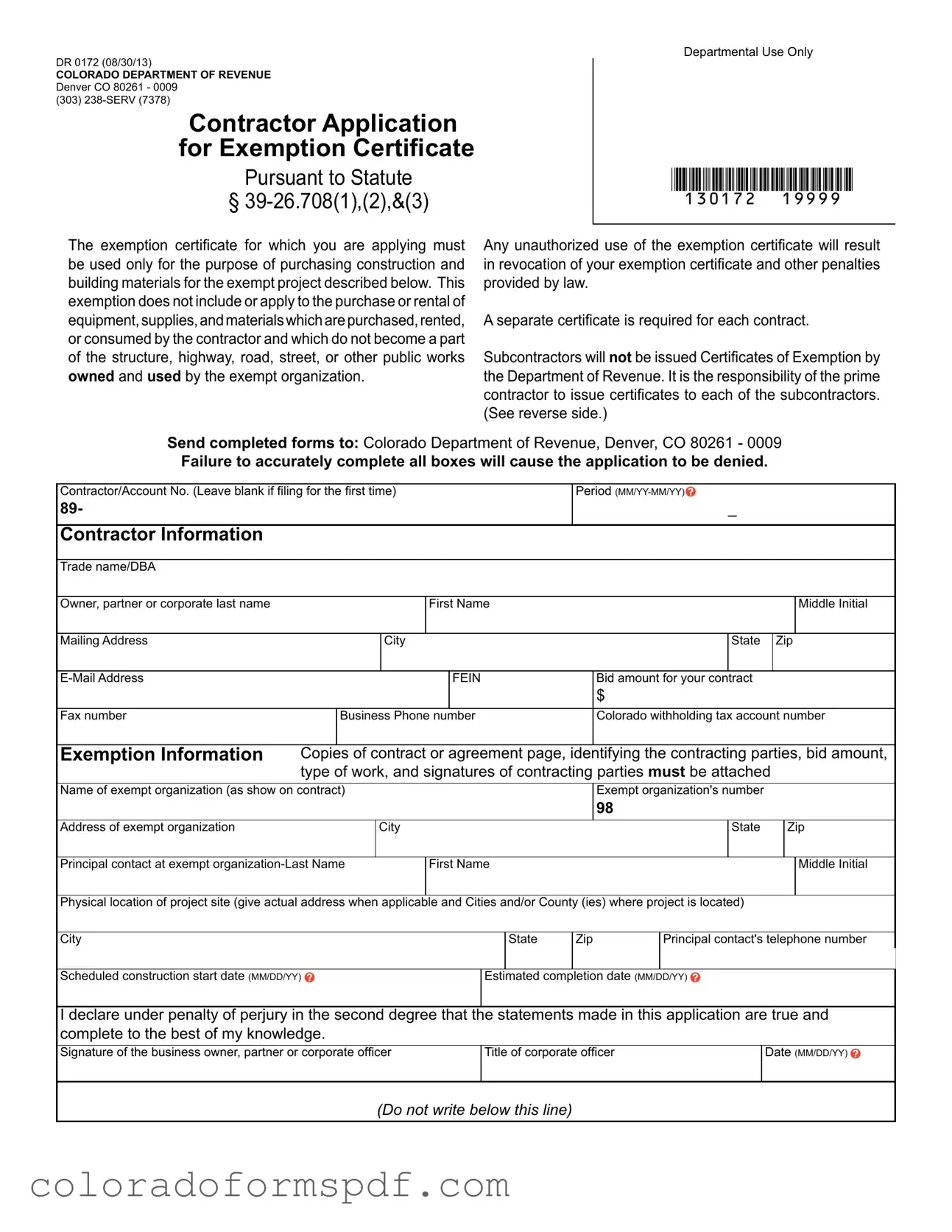

Get Dr 0172 Colorado Form

The DR 0172 Colorado form is a Contractor Application for Exemption Certificate that allows contractors to purchase construction materials for exempt projects without incurring sales tax. This form is essential for ensuring compliance with state regulations while facilitating the procurement of necessary building supplies. Accurate completion of this form is crucial, as any mistakes may lead to denial of the application.

Get Document Online

Get Dr 0172 Colorado Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Dr 0172 Colorado online, then download.