Get Colorado Uitr 6A Form

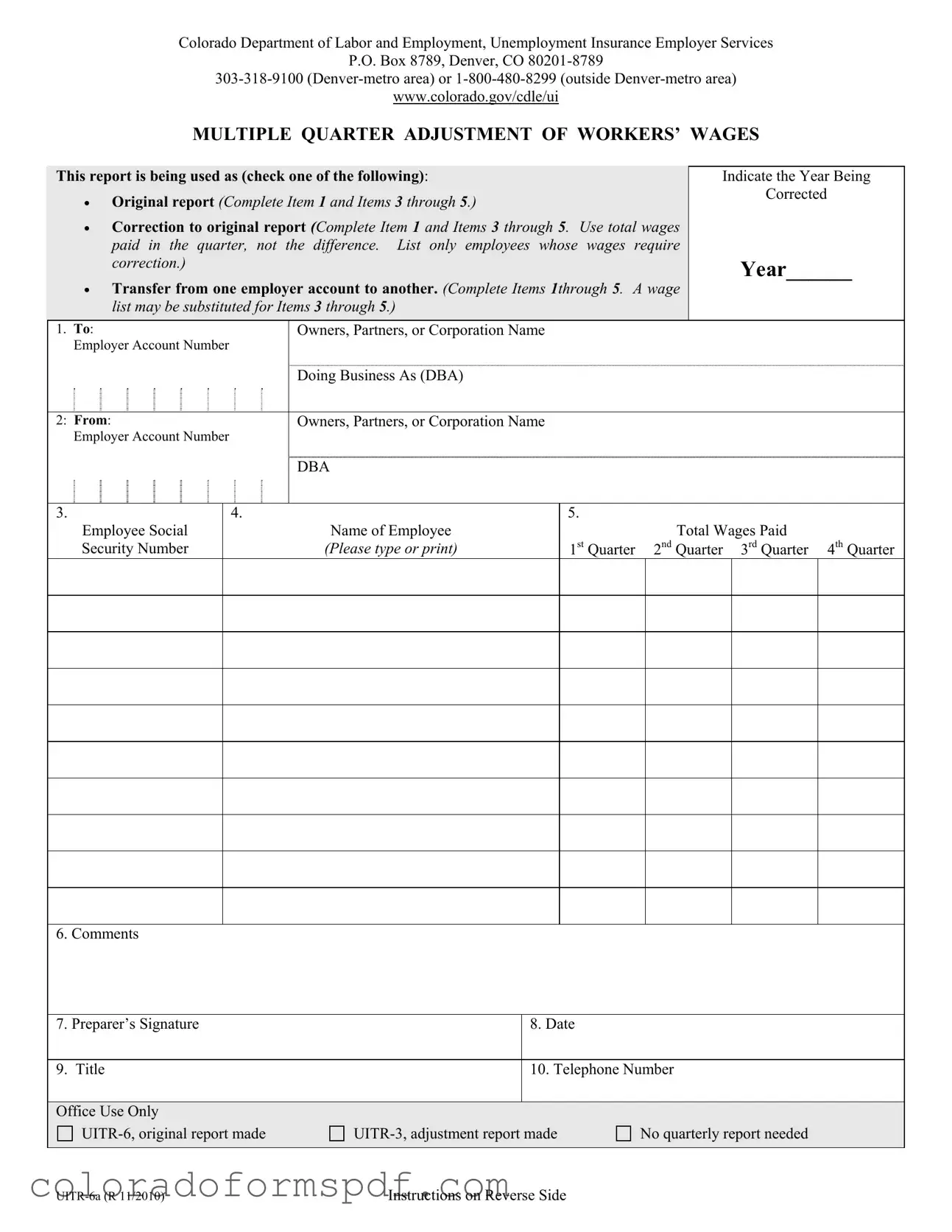

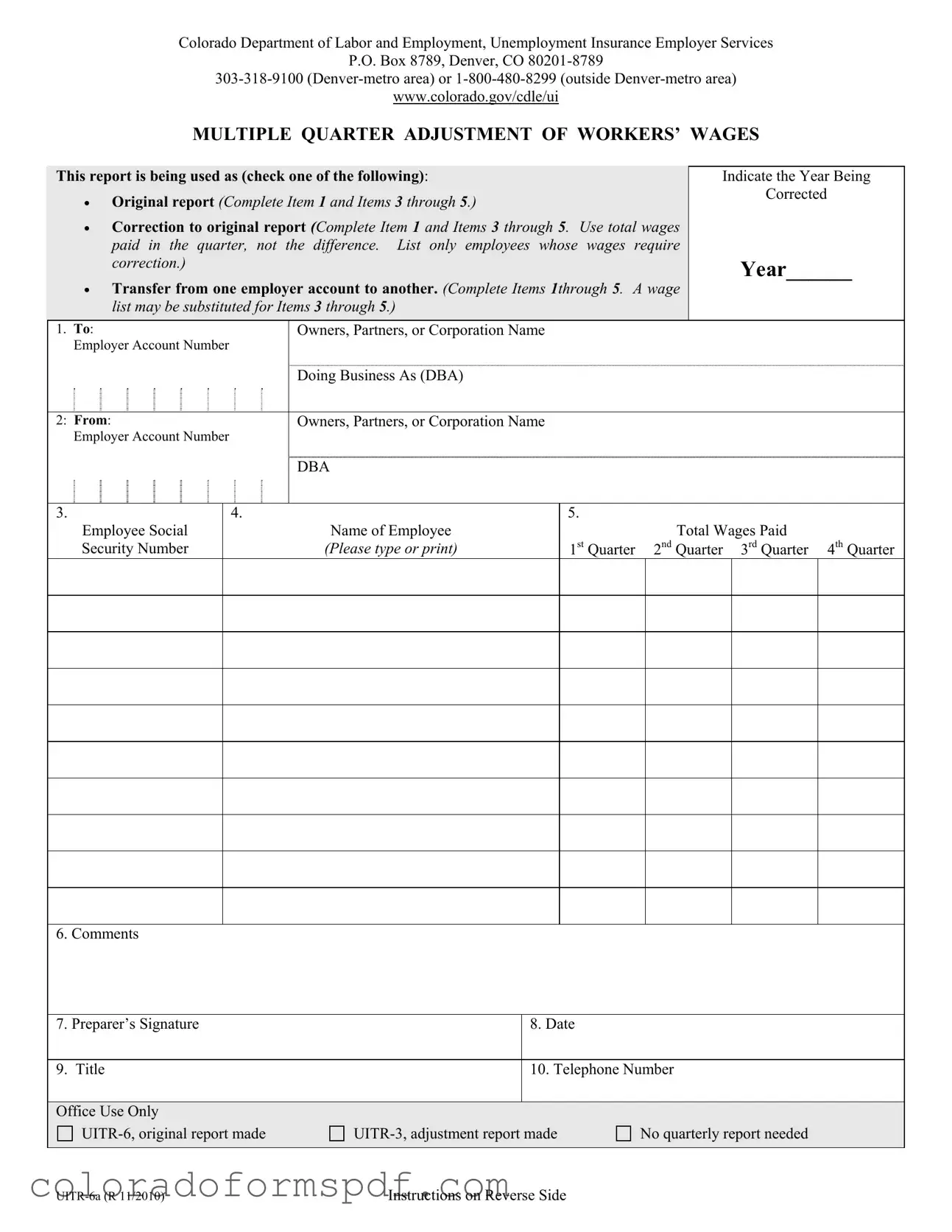

The Colorado UITR 6A form is a document used by employers to report adjustments related to workers' wages. This form serves three primary purposes: to report wages that were never previously reported, to correct previously reported wages, and to transfer earnings between employer accounts. Completing this form accurately is essential for maintaining compliance with unemployment insurance regulations in Colorado.

Get Document Online

Get Colorado Uitr 6A Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Colorado Uitr 6A online, then download.