Get Colorado Tax Form

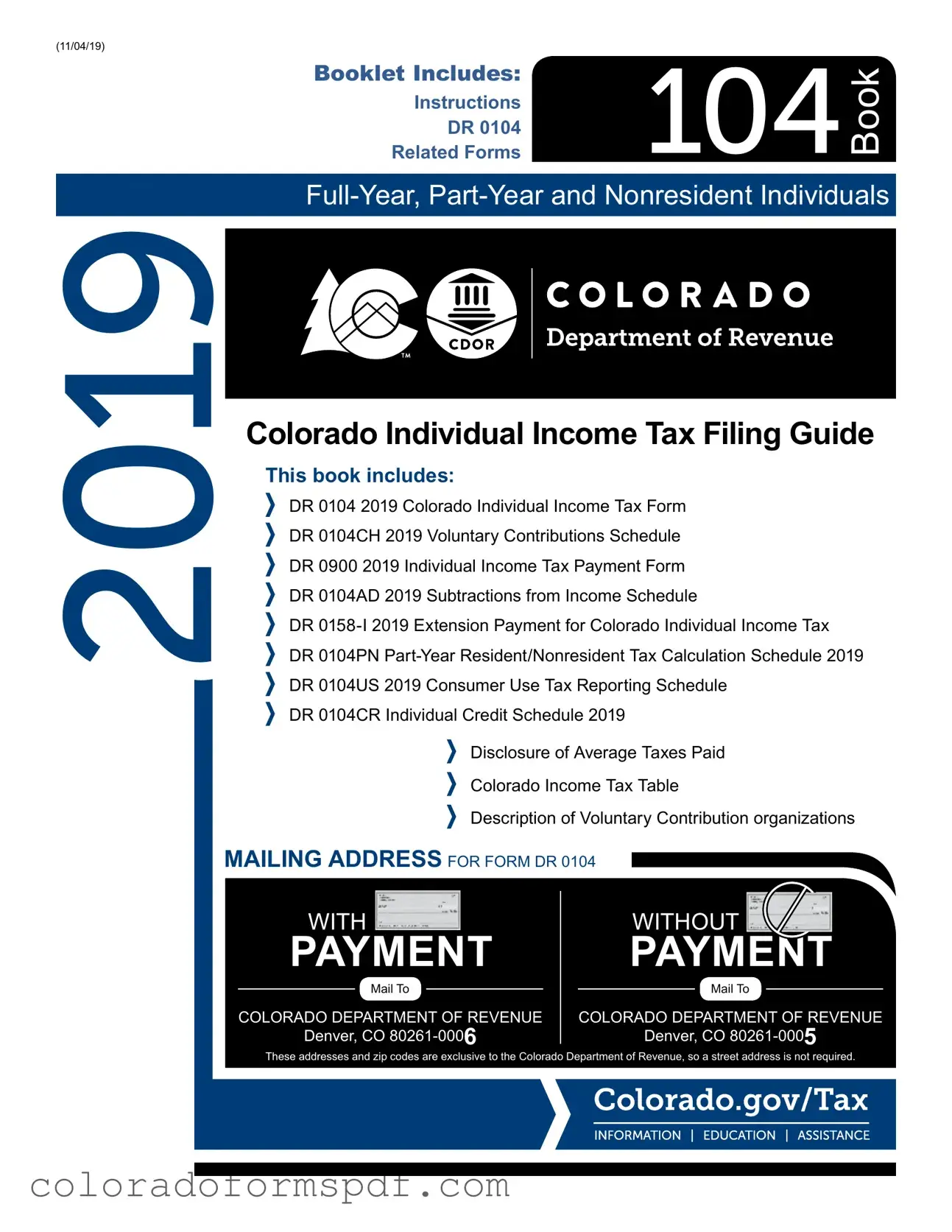

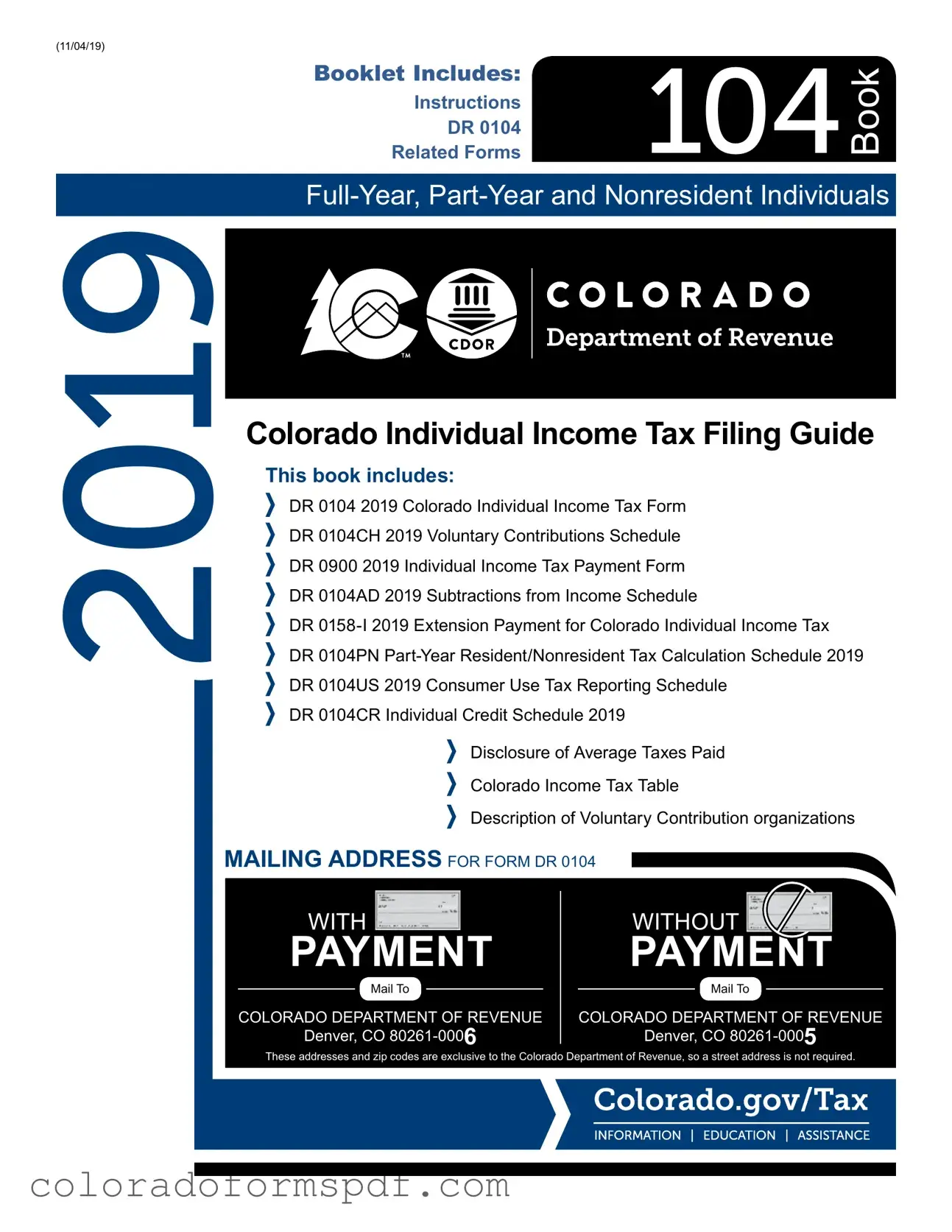

The Colorado Tax Form is a document used by residents and non-residents to report their income and calculate their state tax liability. This form, officially known as the DR 0104, is essential for individuals who earn income in Colorado, whether they reside in the state full-time, part-time, or not at all. Understanding how to accurately complete this form is crucial for ensuring compliance with Colorado tax laws and for maximizing potential tax benefits.

Get Document Online

Get Colorado Tax Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Colorado Tax online, then download.