Get Colorado Exemption Form

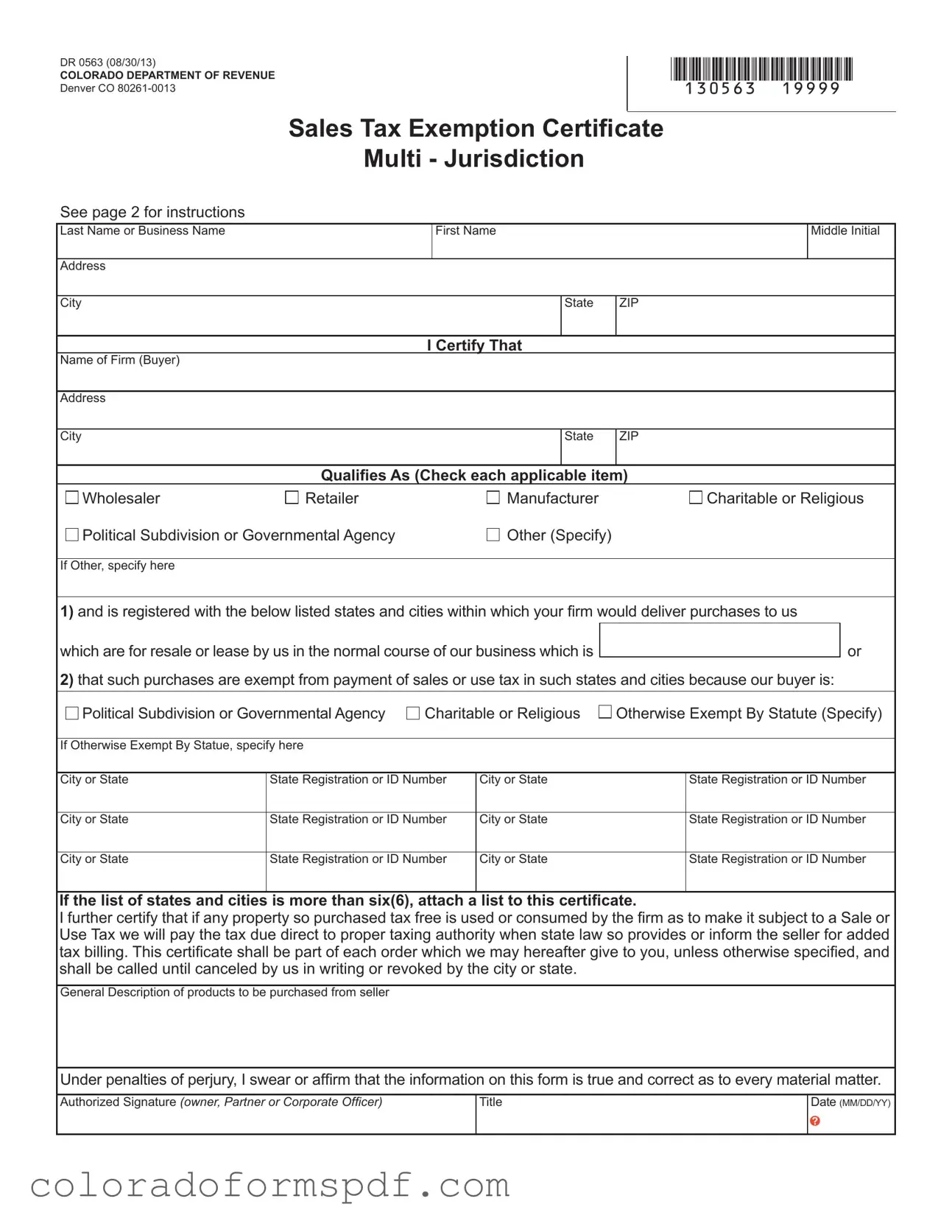

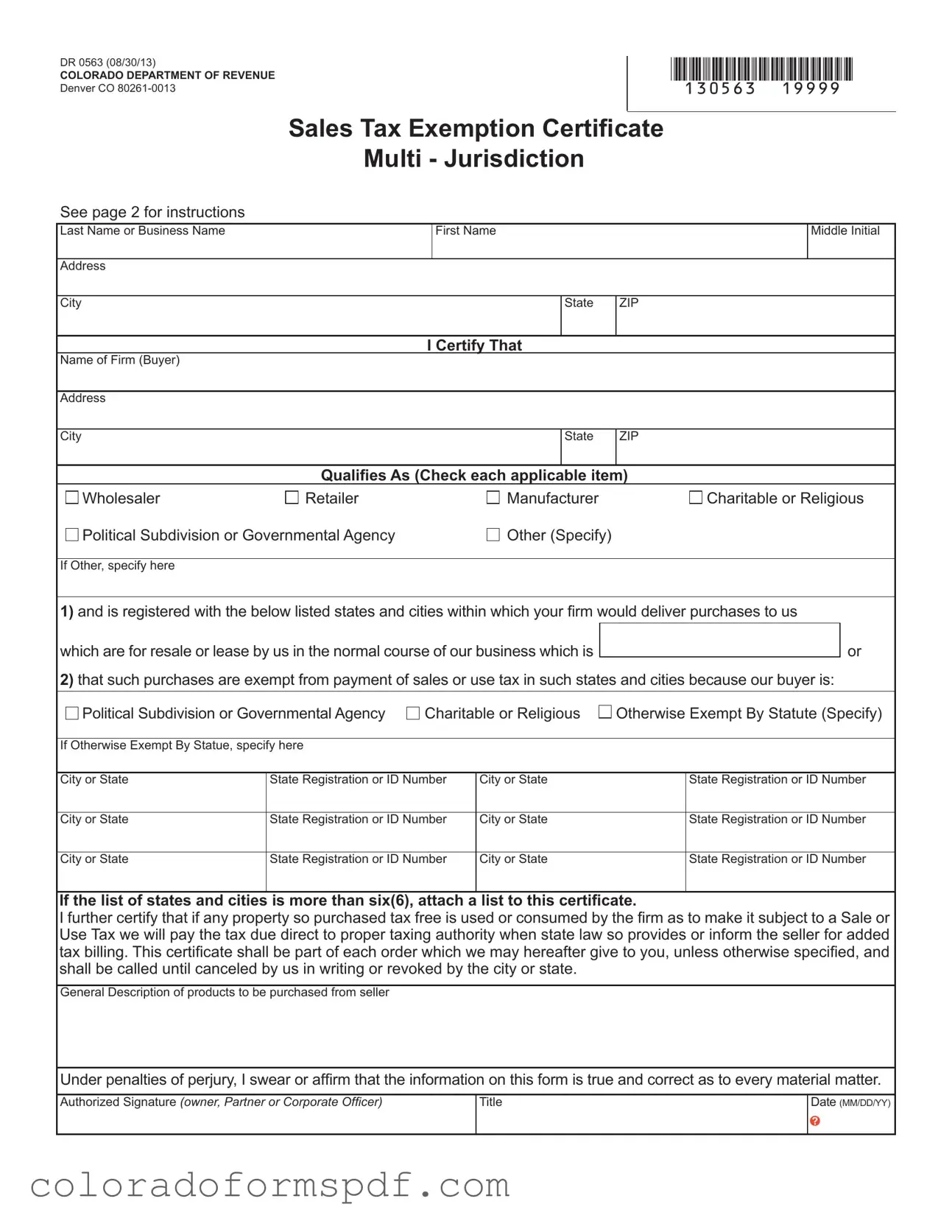

The Colorado Exemption Form is a crucial document that allows businesses to claim exemption from sales tax under specific circumstances. This form, officially known as DR 0563, is essential for ensuring compliance with state and local tax laws when purchasing items for resale or lease. By completing this form accurately, businesses can avoid unnecessary tax burdens while adhering to legal requirements.

Get Document Online

Get Colorado Exemption Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Colorado Exemption online, then download.