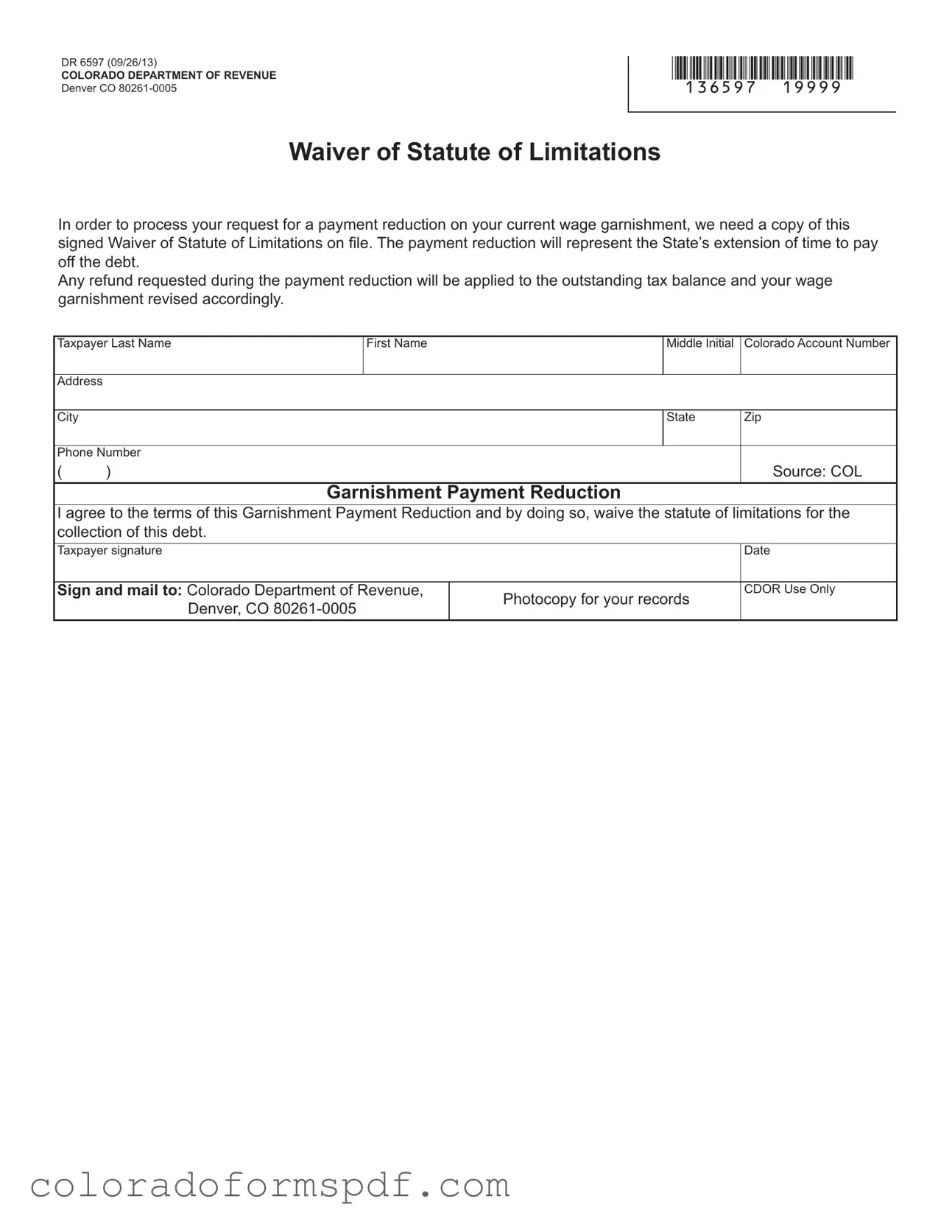

Get Colorado Dr 6597 Form

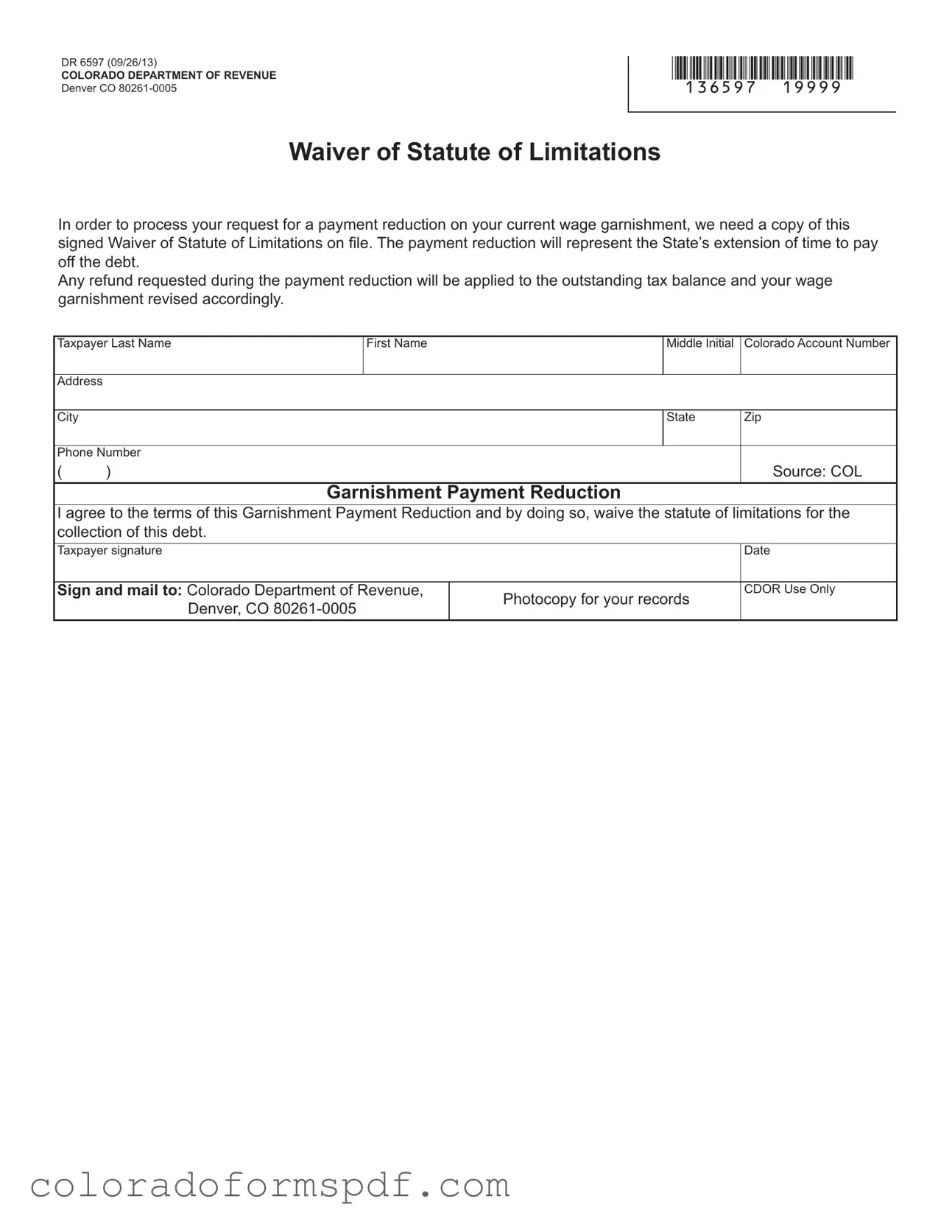

The Colorado Dr 6597 form is a document used to request a payment reduction on current wage garnishments. By signing this form, taxpayers waive the statute of limitations for the collection of their debt, allowing for an extension of time to pay. This process ensures that any refunds requested will be applied to the outstanding tax balance, and the wage garnishment will be adjusted accordingly.

Get Document Online

Get Colorado Dr 6597 Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Colorado Dr 6597 online, then download.