Get Colorado Dr 2667 Form

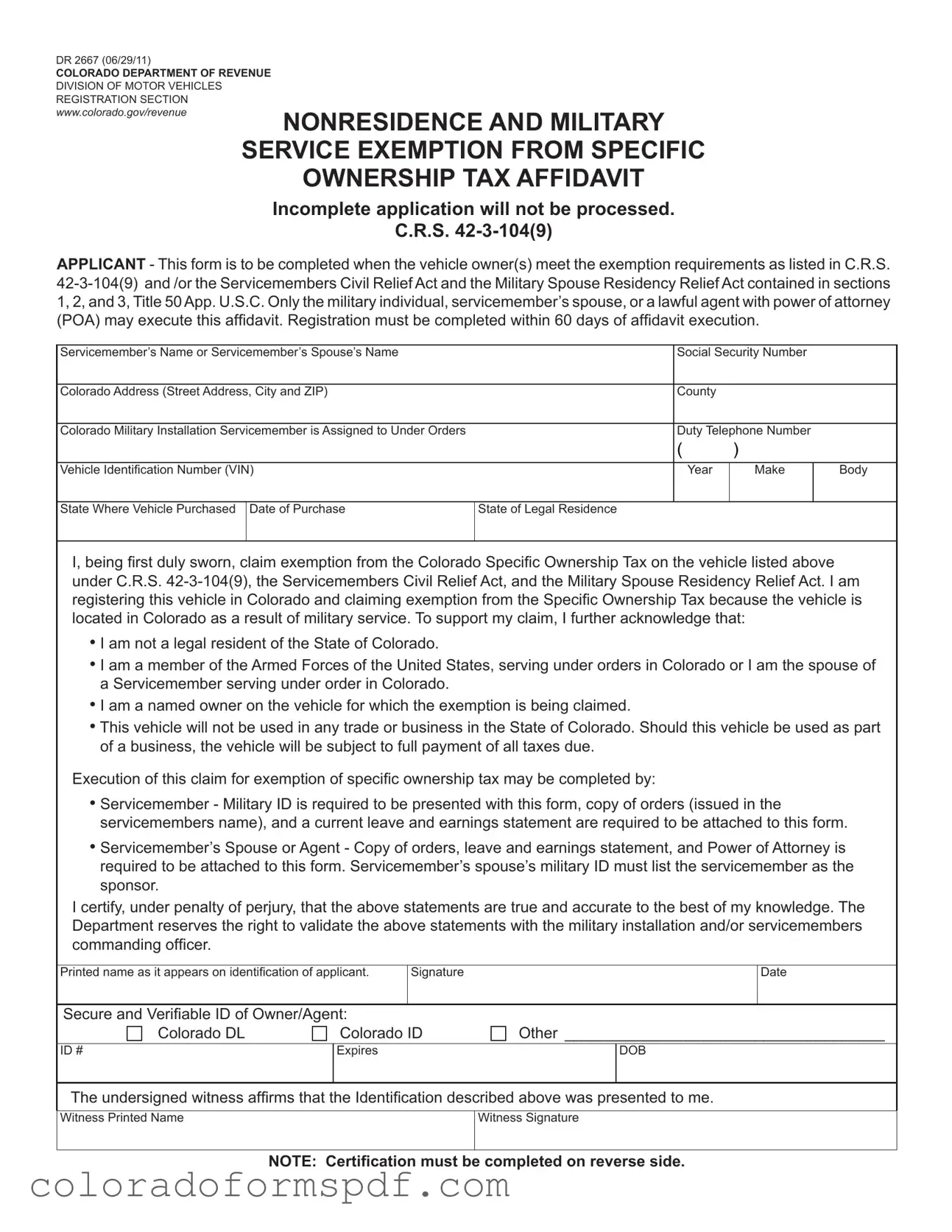

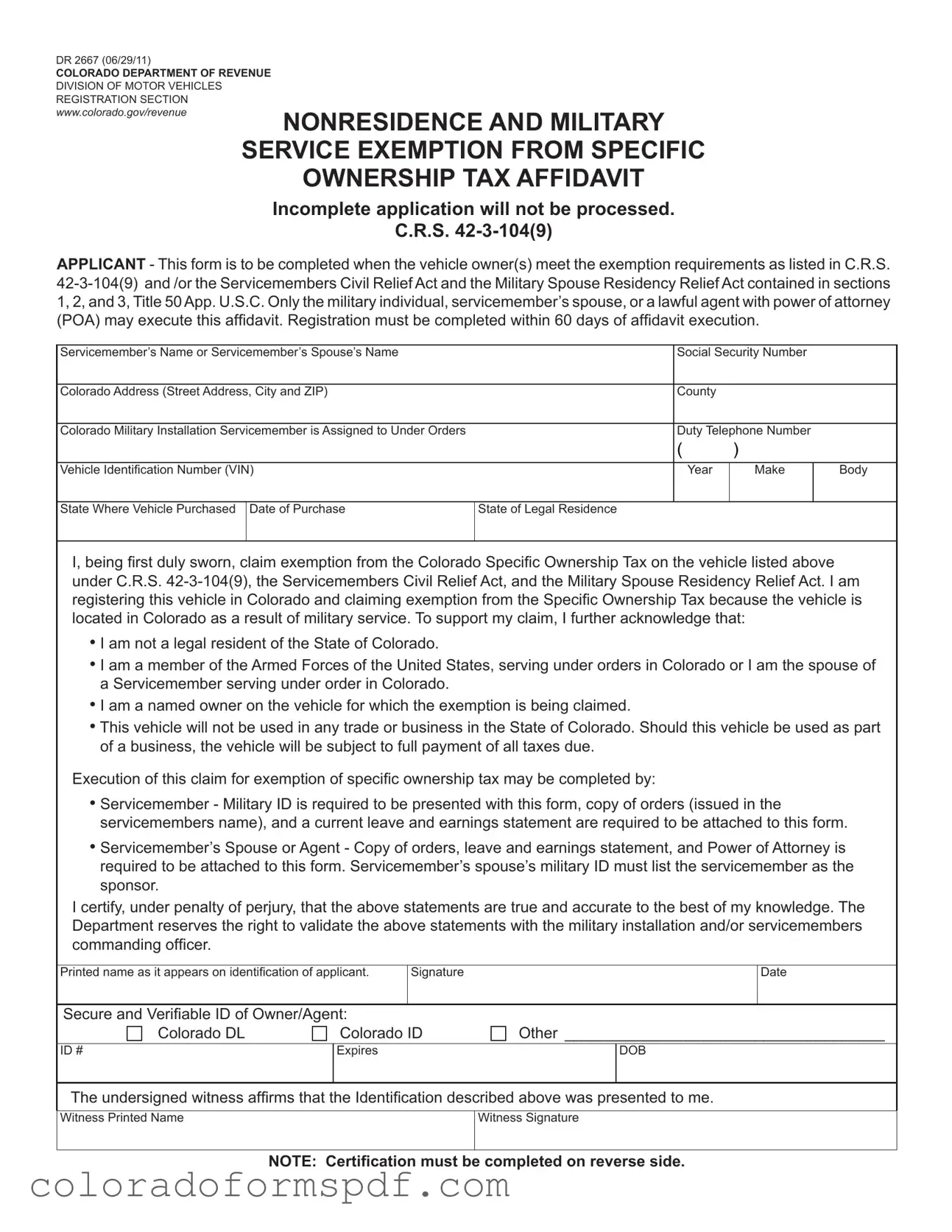

The Colorado DR 2667 form is an affidavit that allows certain vehicle owners, specifically military servicemembers and their spouses, to claim an exemption from the specific ownership tax in Colorado. This form is essential for individuals who meet the criteria outlined in Colorado Revised Statutes and the Servicemembers Civil Relief Act. Proper completion and submission of this form within the specified timeframe can provide significant financial relief for eligible applicants.

Get Document Online

Get Colorado Dr 2667 Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Colorado Dr 2667 online, then download.