Get Colorado Dr 1317 Form

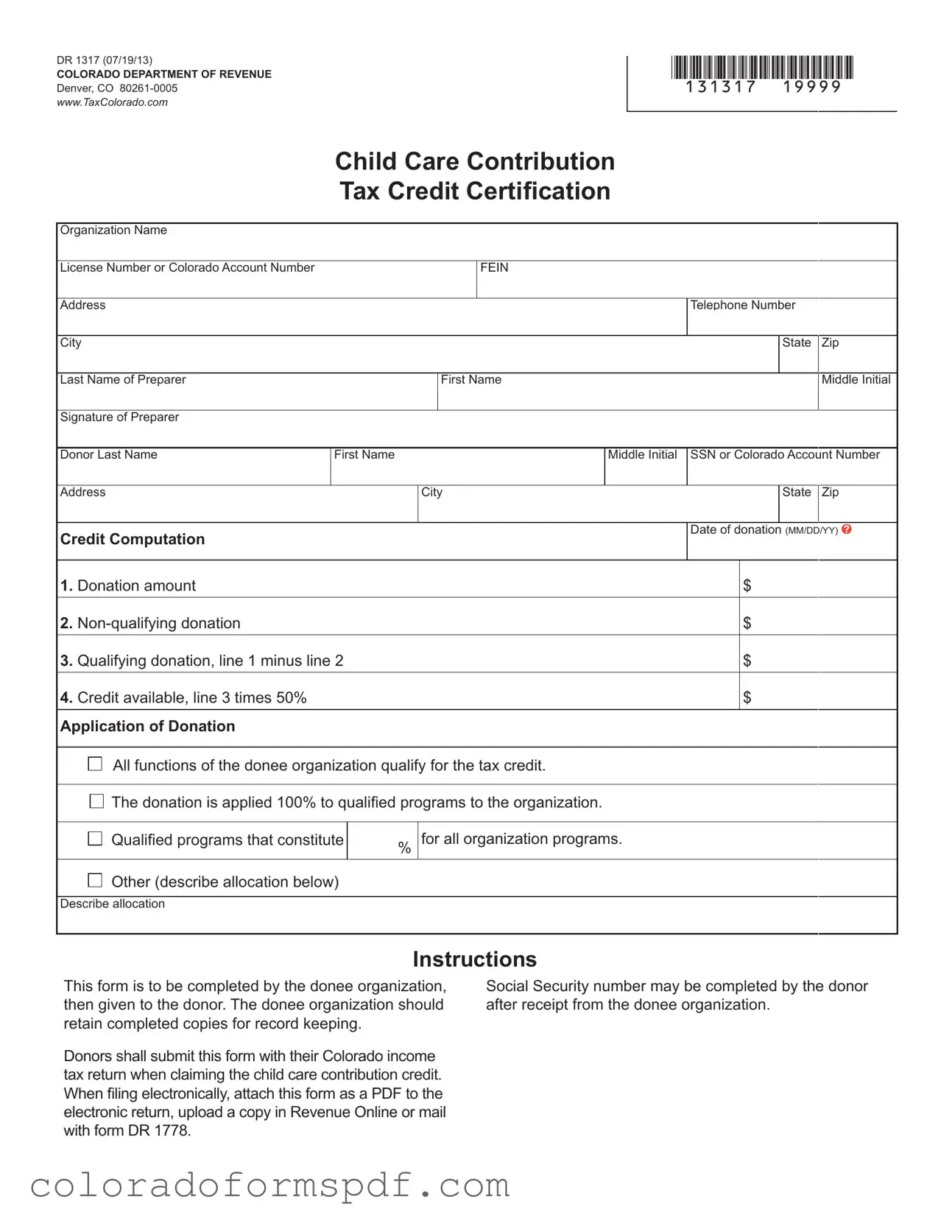

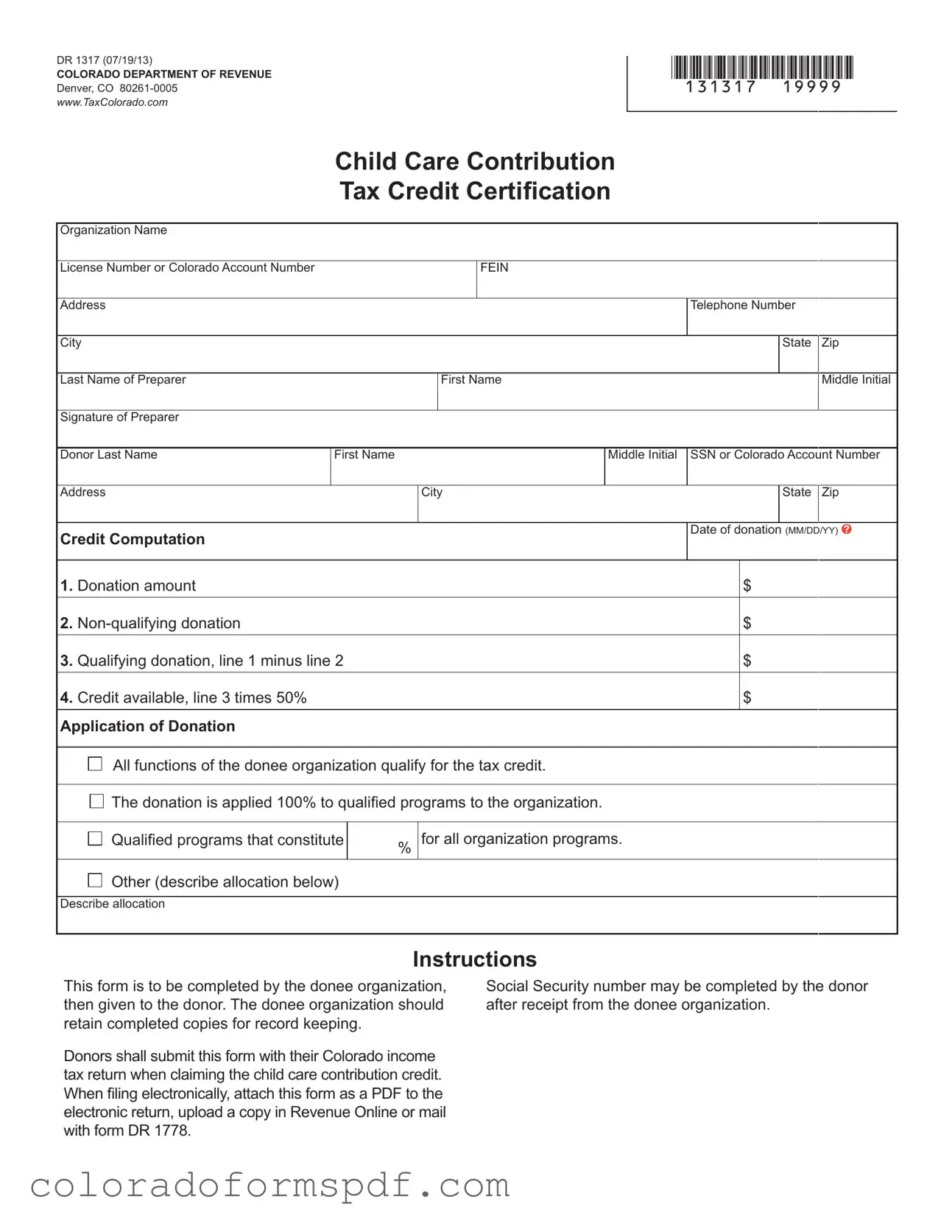

The Colorado DR 1317 form is a certification used to claim the Child Care Contribution Tax Credit. This form is completed by the donee organization and is essential for donors wishing to receive a tax credit for their contributions to qualifying child care programs. Proper completion and submission of this form can significantly benefit both the donor and the organization receiving the donation.

Get Document Online

Get Colorado Dr 1317 Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Colorado Dr 1317 online, then download.