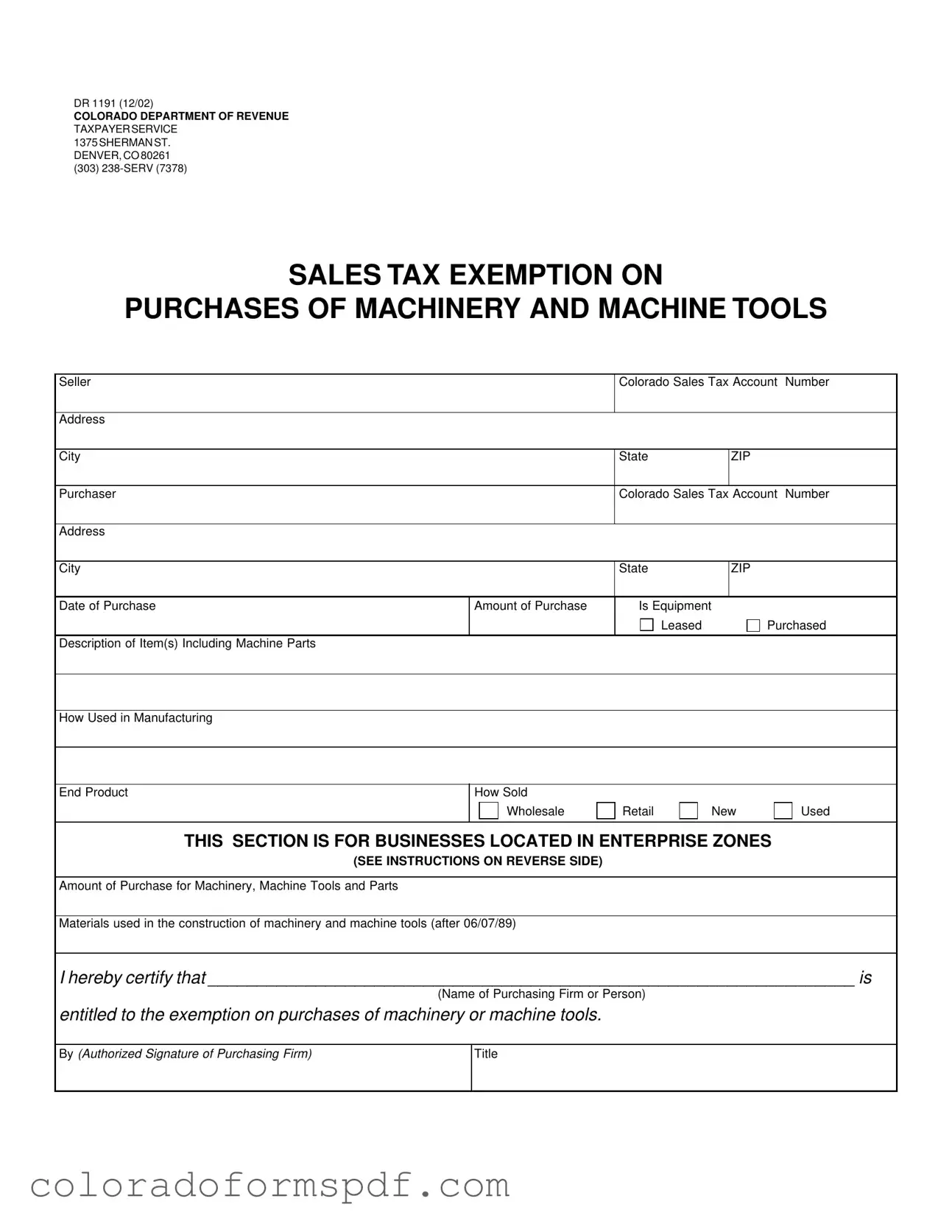

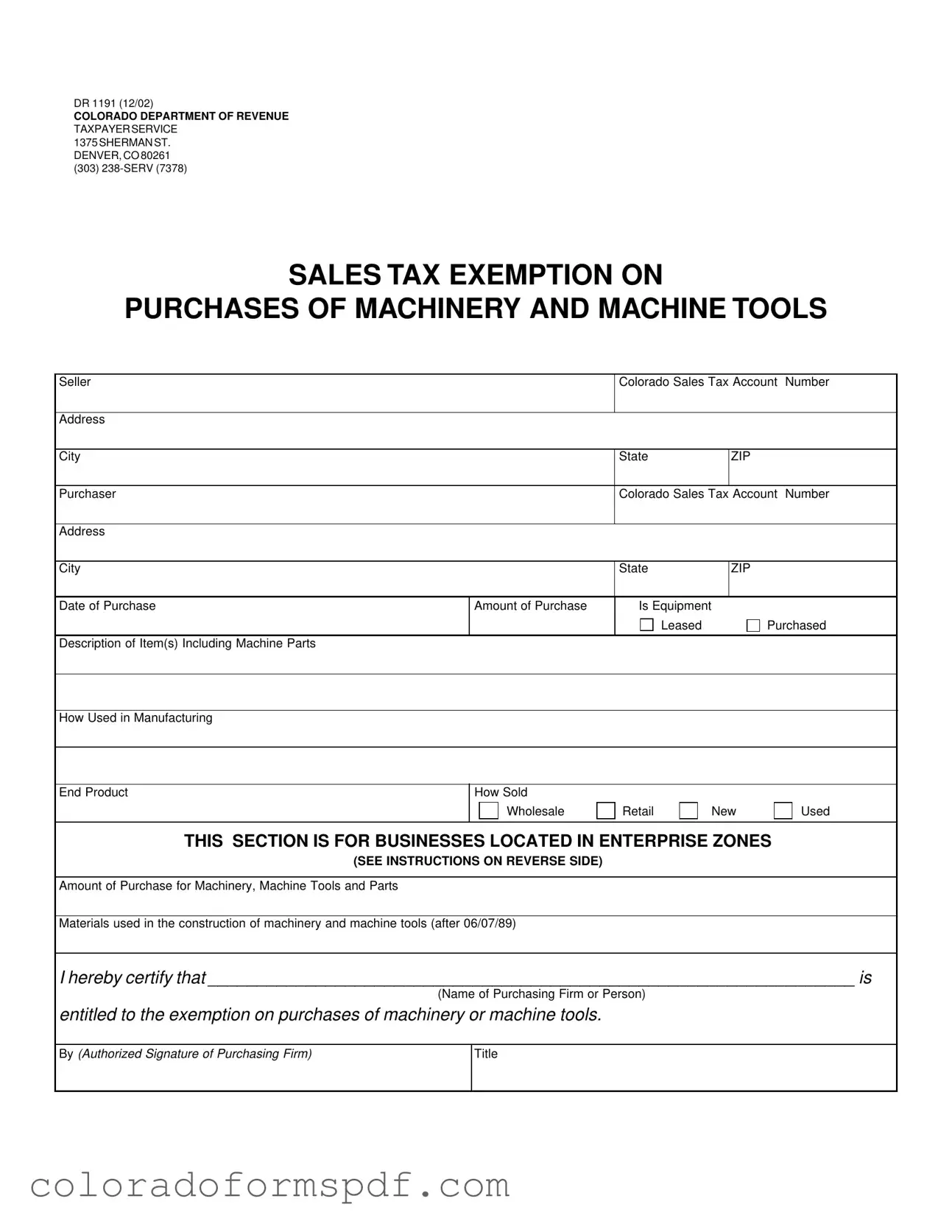

Get Colorado Dr 1191 Form

The Colorado DR 1191 form is a document utilized by businesses to claim a sales tax exemption on the purchase of machinery and machine tools intended for manufacturing. This exemption applies when the machinery is used directly in the production of tangible personal property for sale or profit within the state. Understanding the requirements and processes associated with this form is essential for businesses seeking to benefit from tax savings in Colorado.

Get Document Online

Get Colorado Dr 1191 Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Colorado Dr 1191 online, then download.