Get Colorado Dr 0204 Form

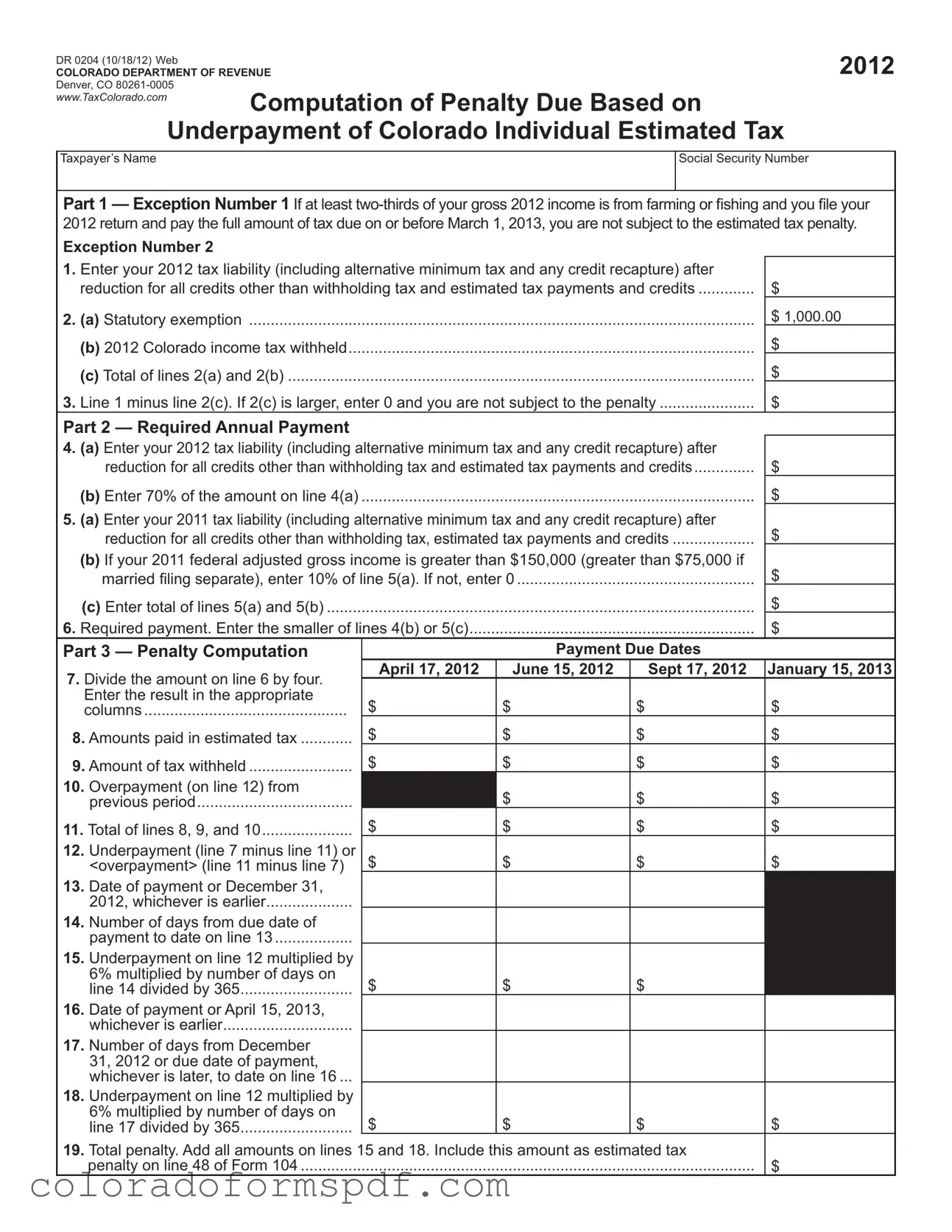

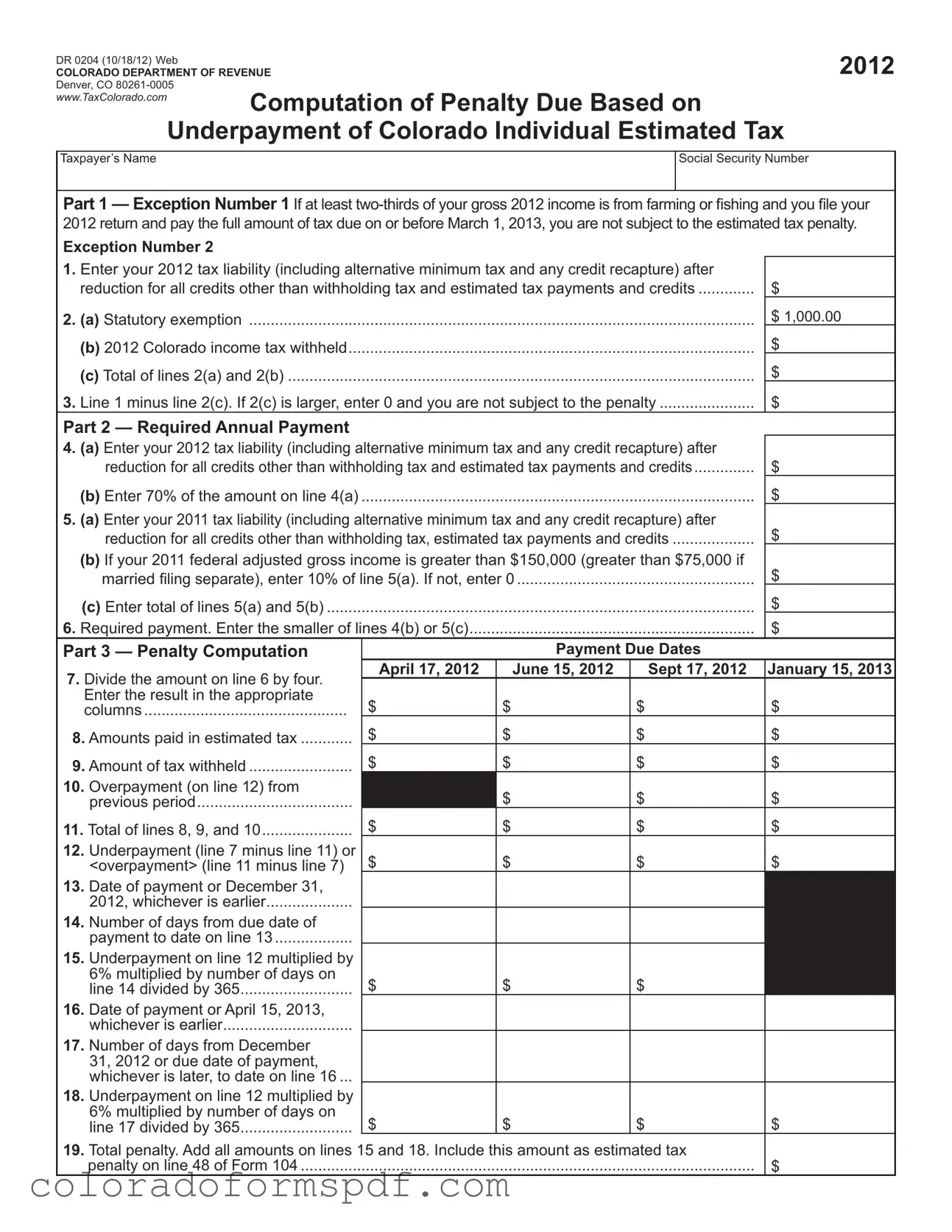

The Colorado DR 0204 form is used to calculate penalties for underpayment of individual estimated taxes in Colorado. Taxpayers must complete this form to determine if they owe a penalty based on their estimated tax payments for the previous year. Understanding the details of this form is essential for ensuring compliance and avoiding unnecessary penalties.

Get Document Online

Get Colorado Dr 0204 Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Colorado Dr 0204 online, then download.