Get Colorado Cr 100 Form

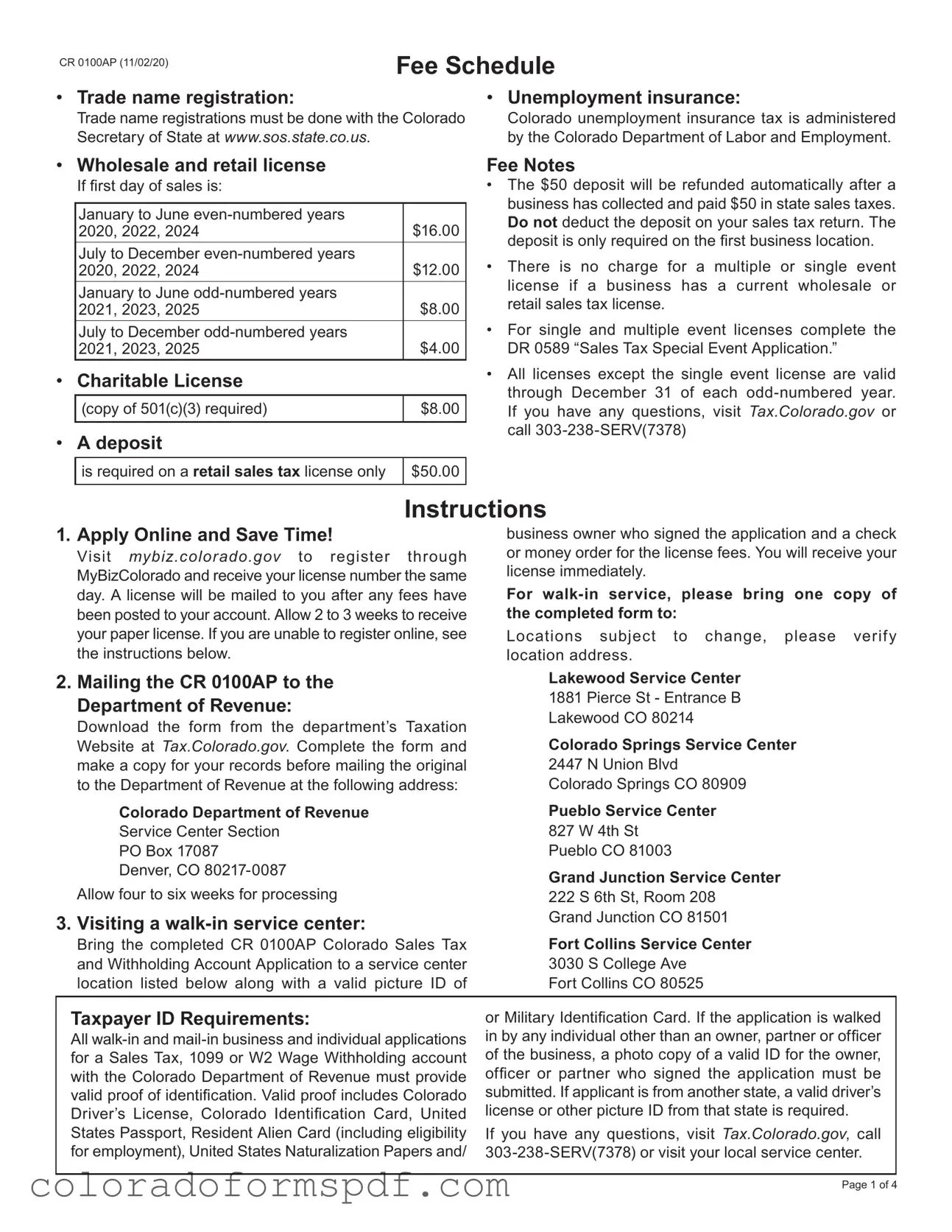

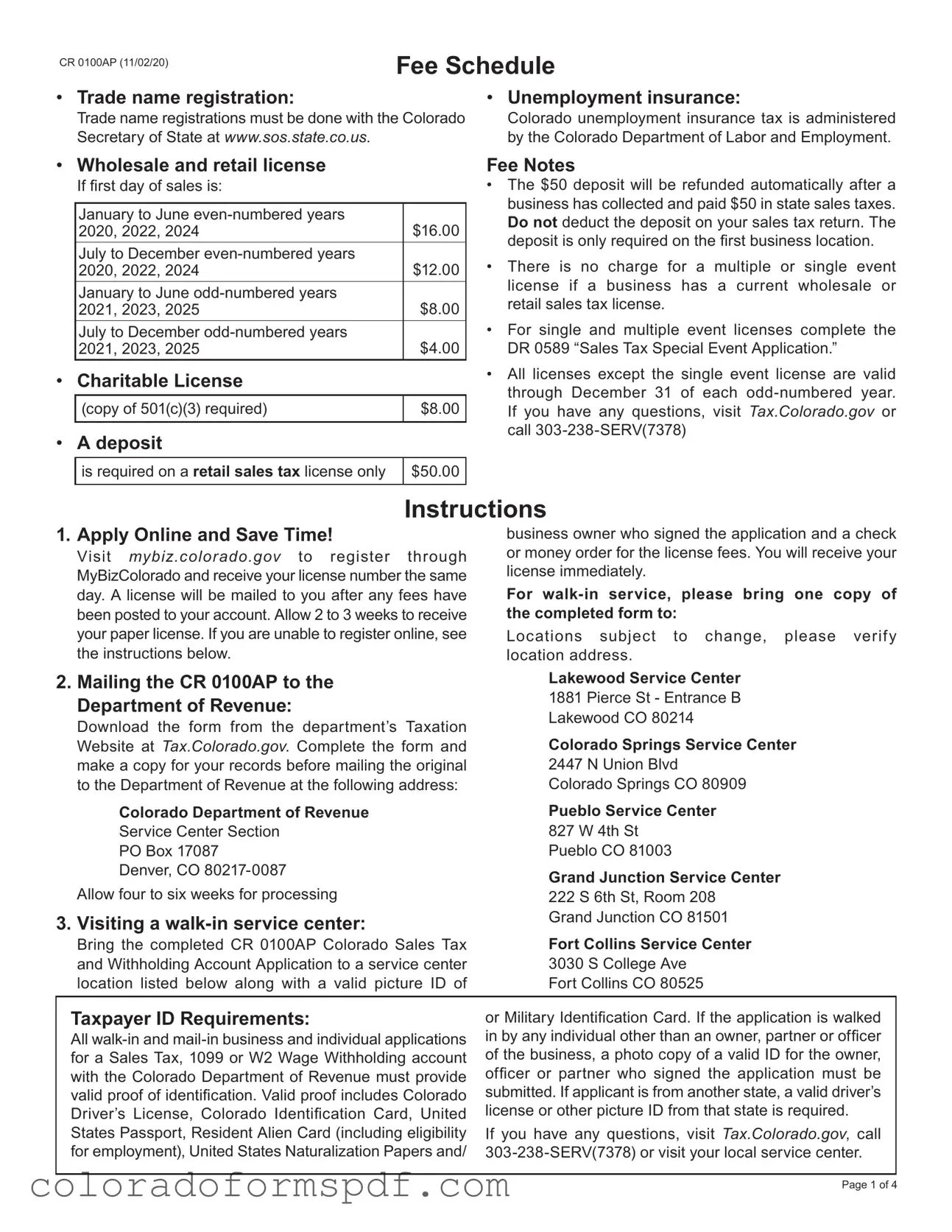

The Colorado CR 100 form, also known as the Colorado Sales Tax and Withholding Account Application, is essential for businesses in Colorado seeking to register for sales tax, W-2 withholding, 1099 withholding, or oil and gas withholding accounts. This form serves as a crucial step in ensuring compliance with state tax regulations and facilitates the collection and remittance of sales taxes. Completing the CR 100 accurately can help streamline the process of obtaining necessary licenses and permits for operating a business in Colorado.

Get Document Online

Get Colorado Cr 100 Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Colorado Cr 100 online, then download.