Get Colorado Correction Form

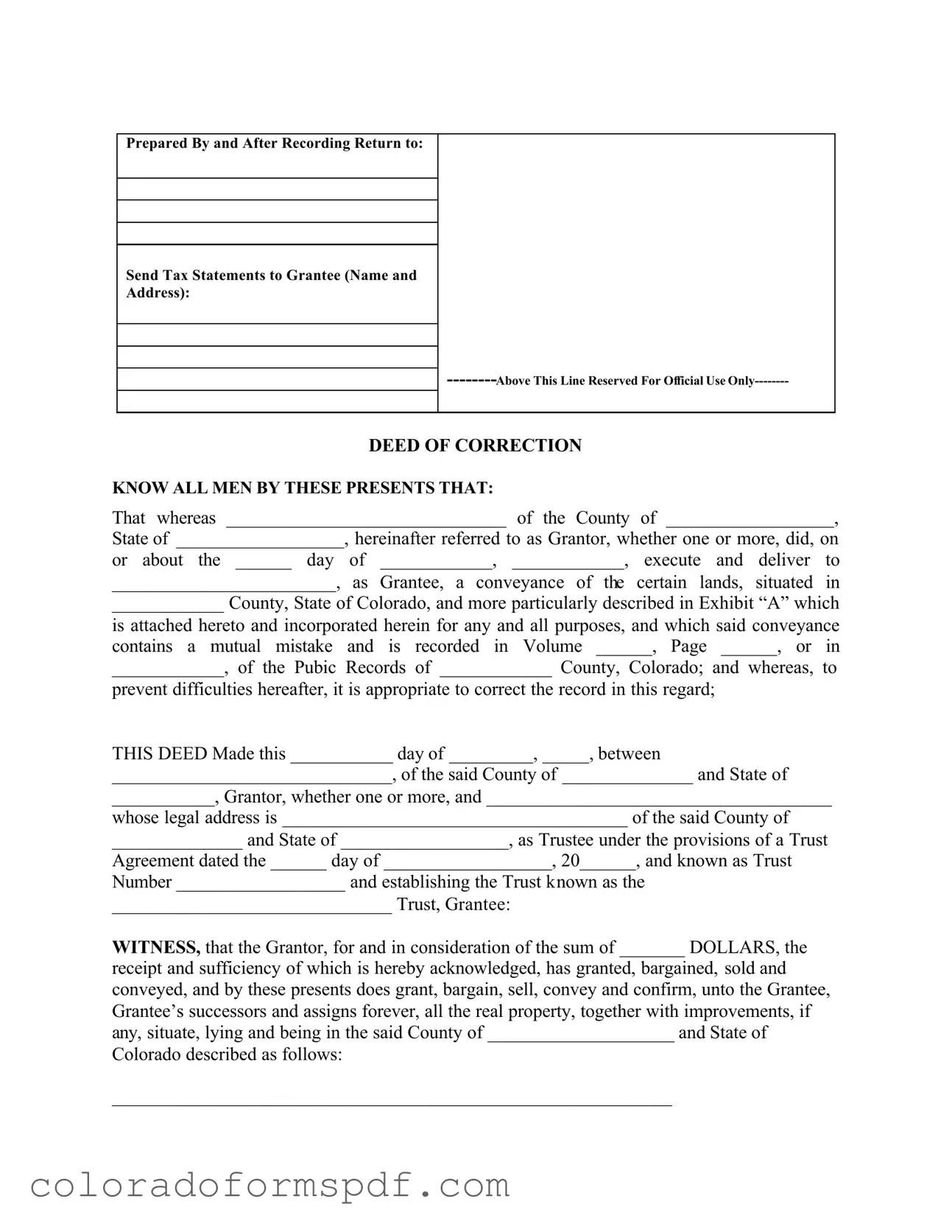

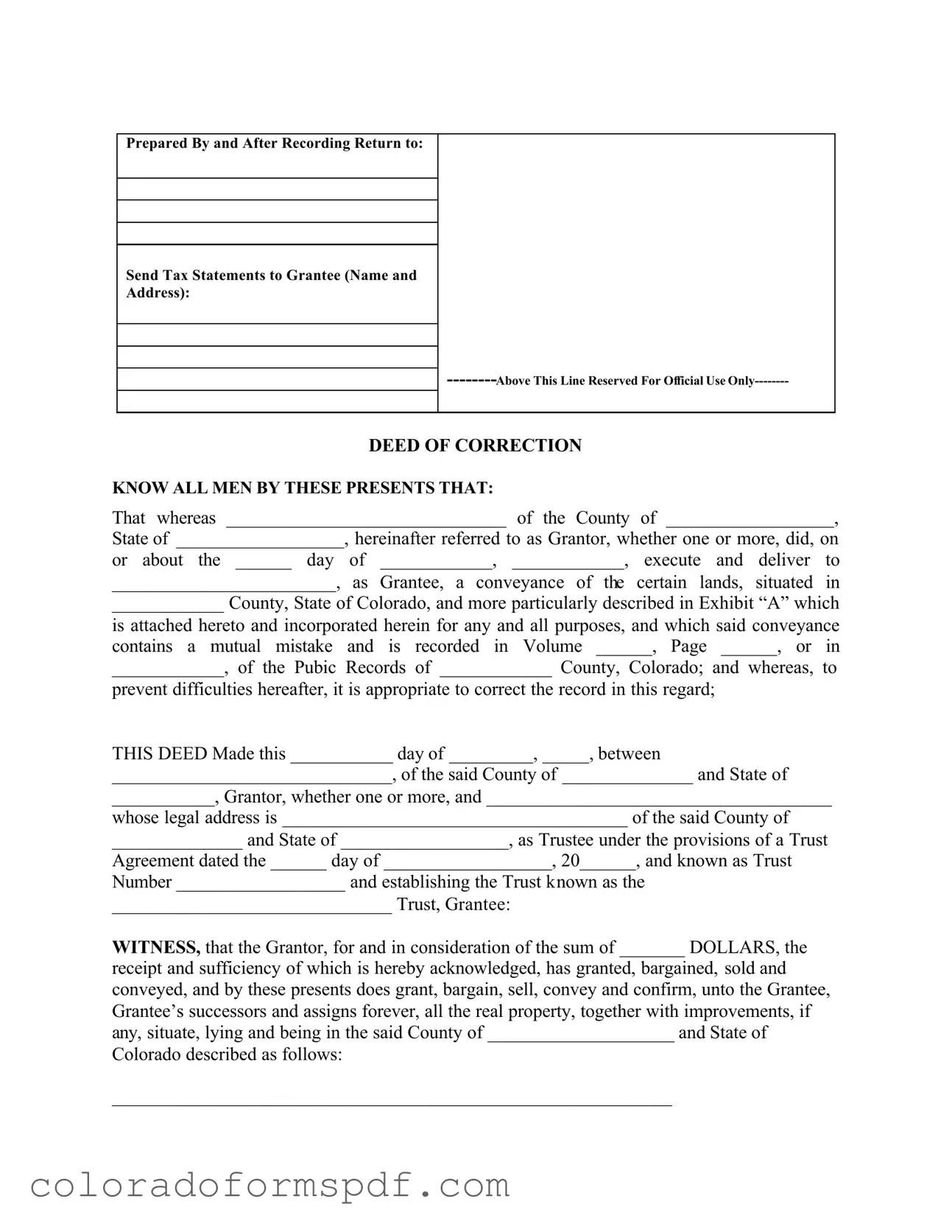

The Colorado Correction form is a legal document used to amend or correct errors in previously recorded property deeds. This form ensures that any mistakes in the original conveyance are officially rectified, thereby maintaining the accuracy of public records. It serves as a vital tool for property owners to safeguard their interests and clarify ownership details.

Get Document Online

Get Colorado Correction Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Colorado Correction online, then download.