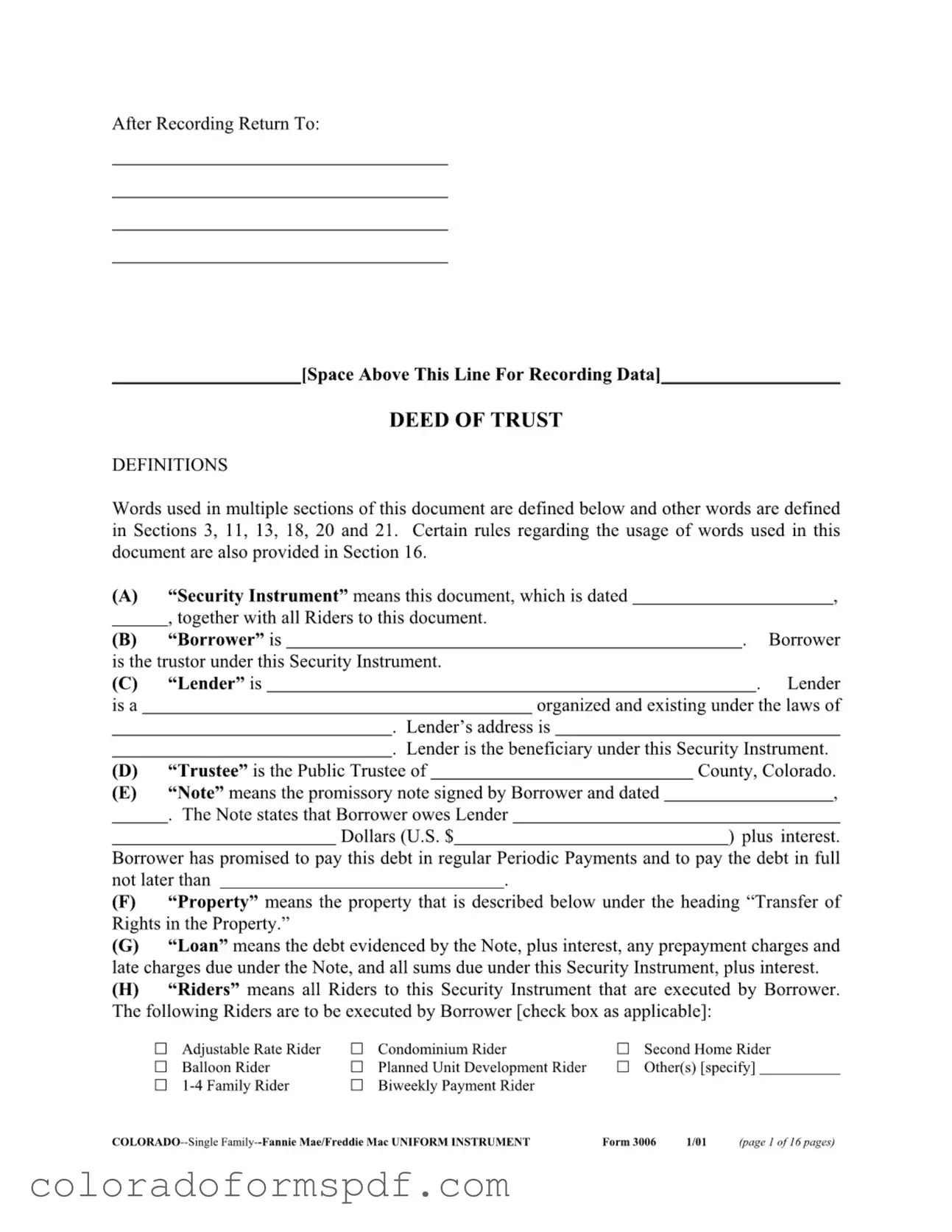

Get Colorado 3006 Form

The Colorado 3006 form is a legal document known as a Deed of Trust, which secures a loan by granting a lender a claim against a property. This form outlines the responsibilities and rights of the borrower, lender, and trustee involved in the transaction. It includes definitions of key terms and conditions that govern the agreement, ensuring all parties understand their obligations.

Get Document Online

Get Colorado 3006 Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Colorado 3006 online, then download.