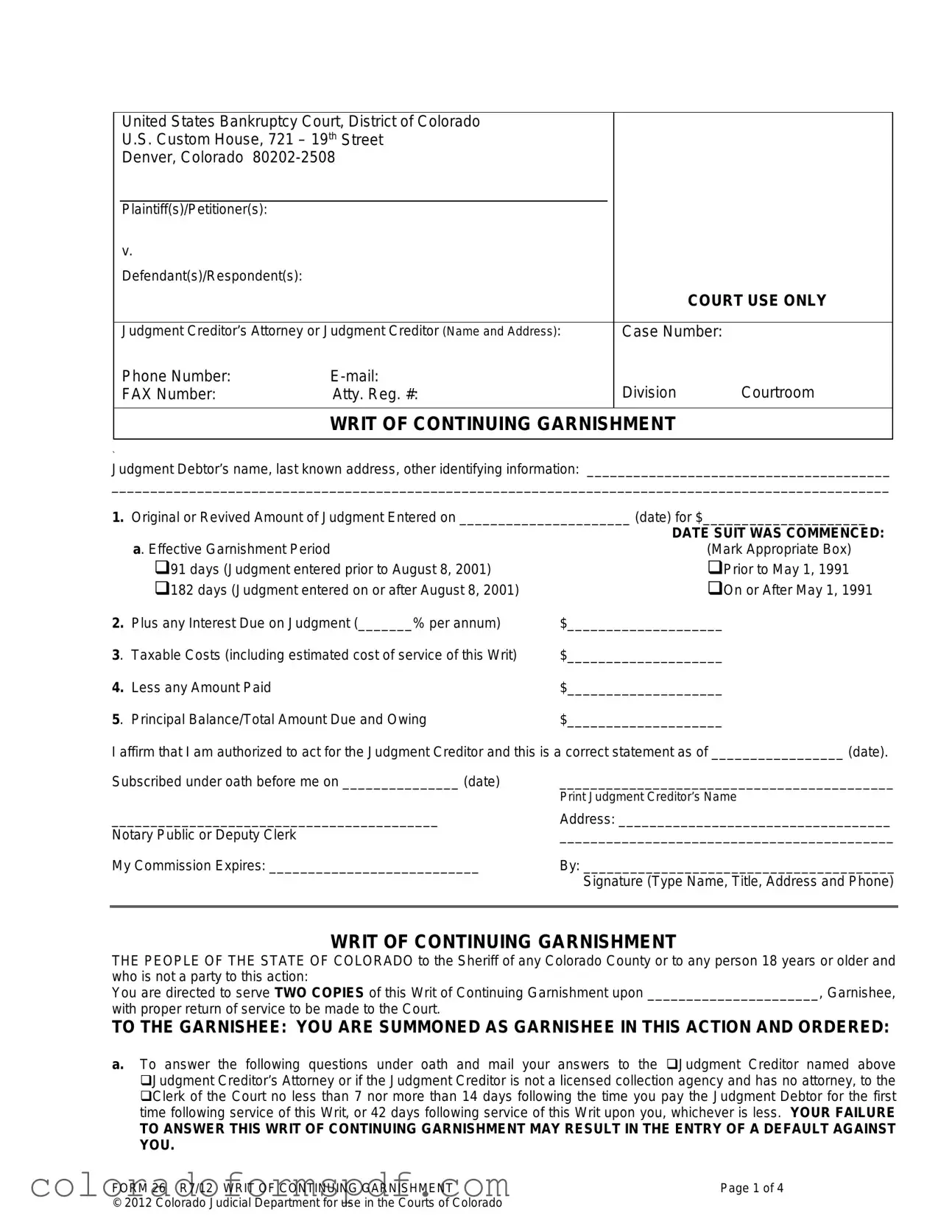

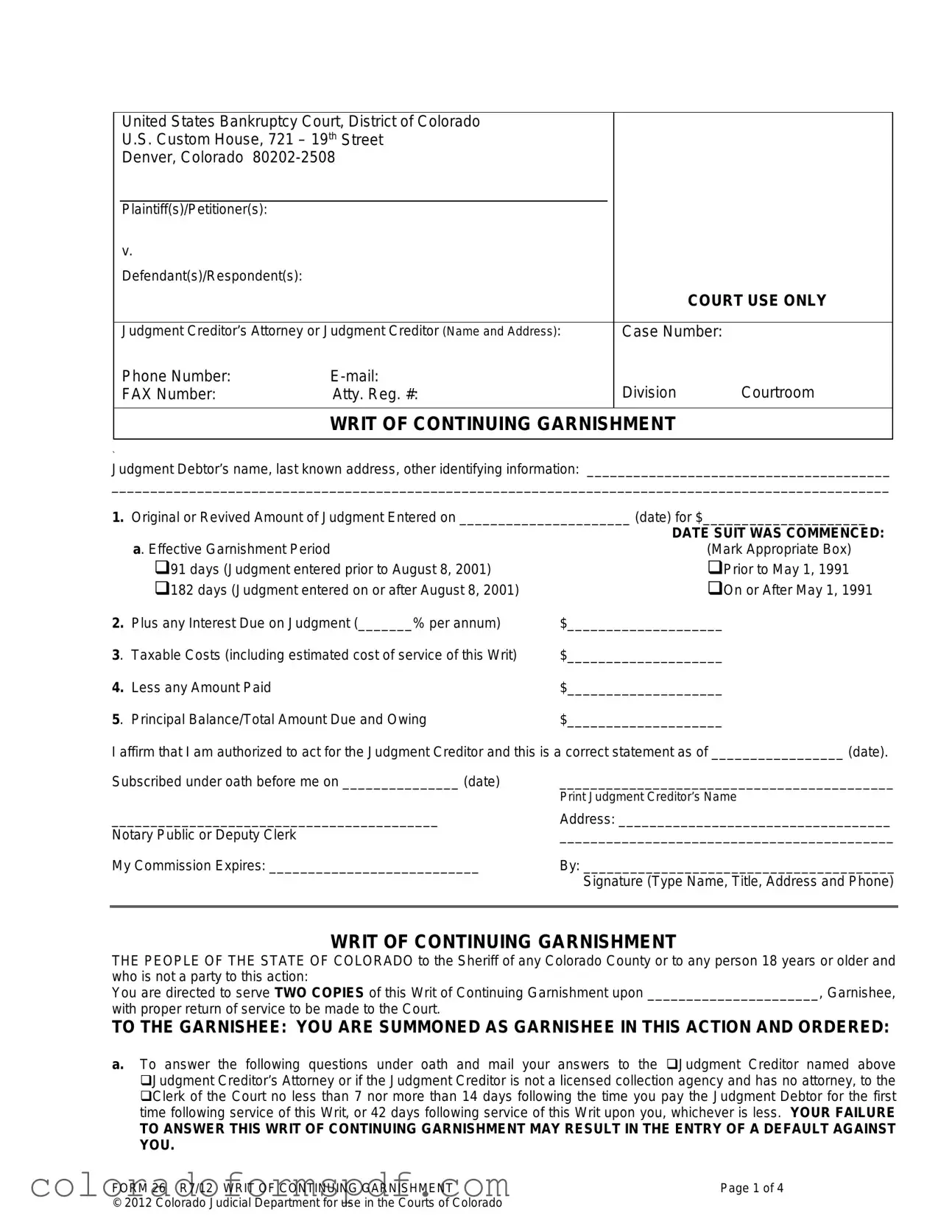

Get Colorado 26 Form

The Colorado 26 form is a legal document used in the U.S. Bankruptcy Court for the District of Colorado to initiate a writ of continuing garnishment. This form allows a judgment creditor to collect debts owed by a judgment debtor through garnishment of their earnings. Understanding the details and requirements of this form is crucial for both creditors and debtors navigating the garnishment process.

Get Document Online

Get Colorado 26 Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Colorado 26 online, then download.