Get Colorado 1Dr 0112Ep Form

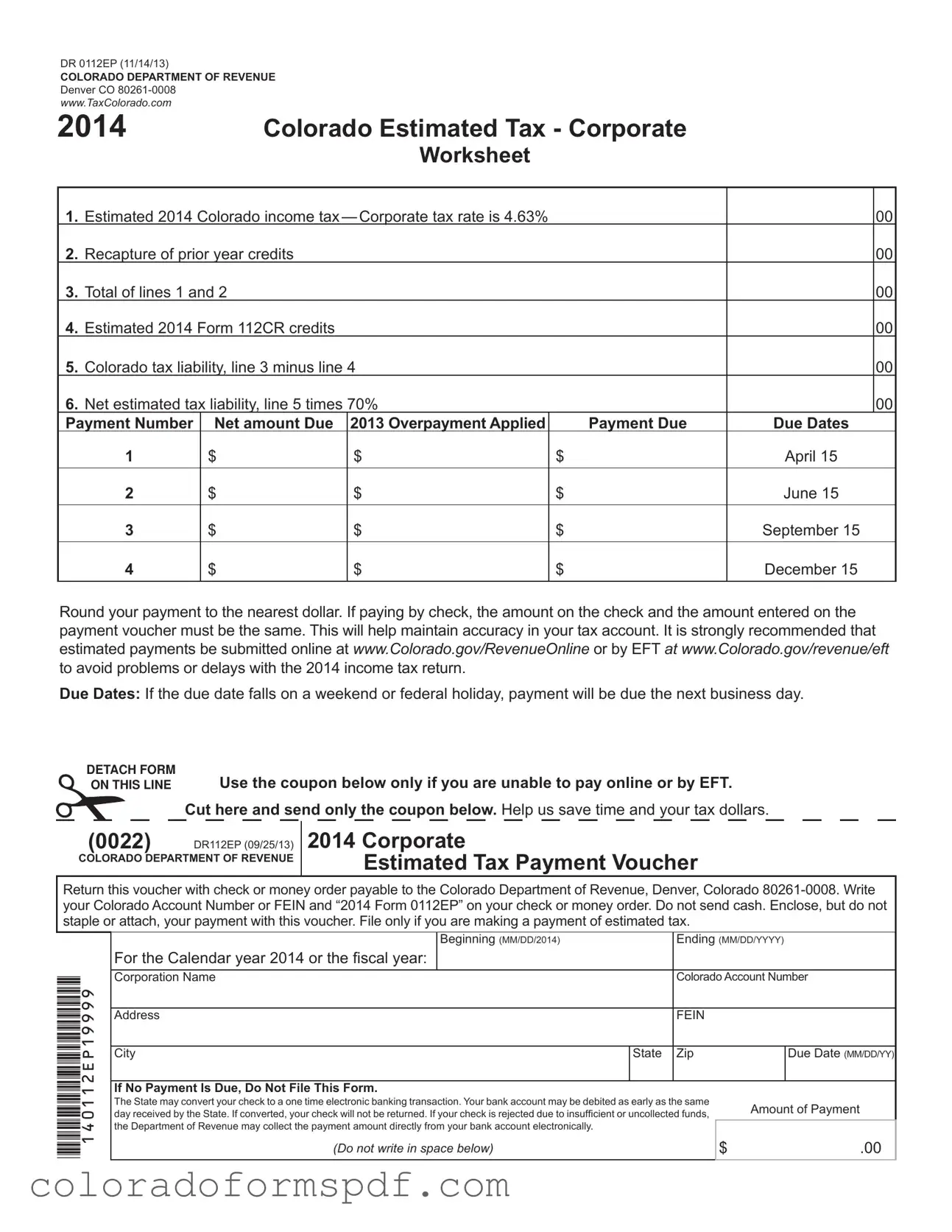

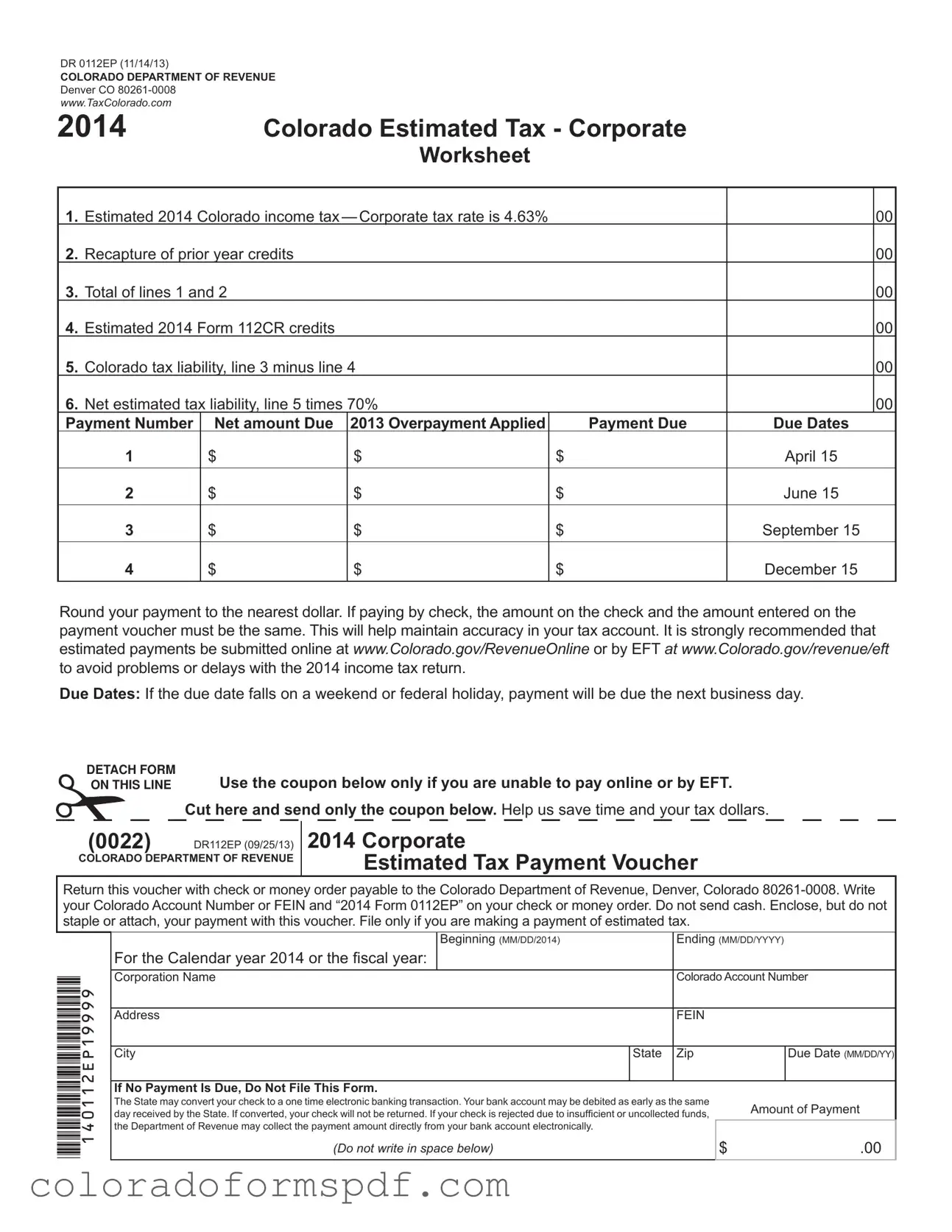

The Colorado 1Dr 0112Ep form is a crucial document used by corporations to report and pay estimated income taxes in Colorado. This form helps businesses calculate their expected tax liability for the year, ensuring compliance with state tax laws. Understanding how to properly complete and submit this form can significantly impact a corporation's financial responsibilities and obligations.

Get Document Online

Get Colorado 1Dr 0112Ep Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Colorado 1Dr 0112Ep online, then download.