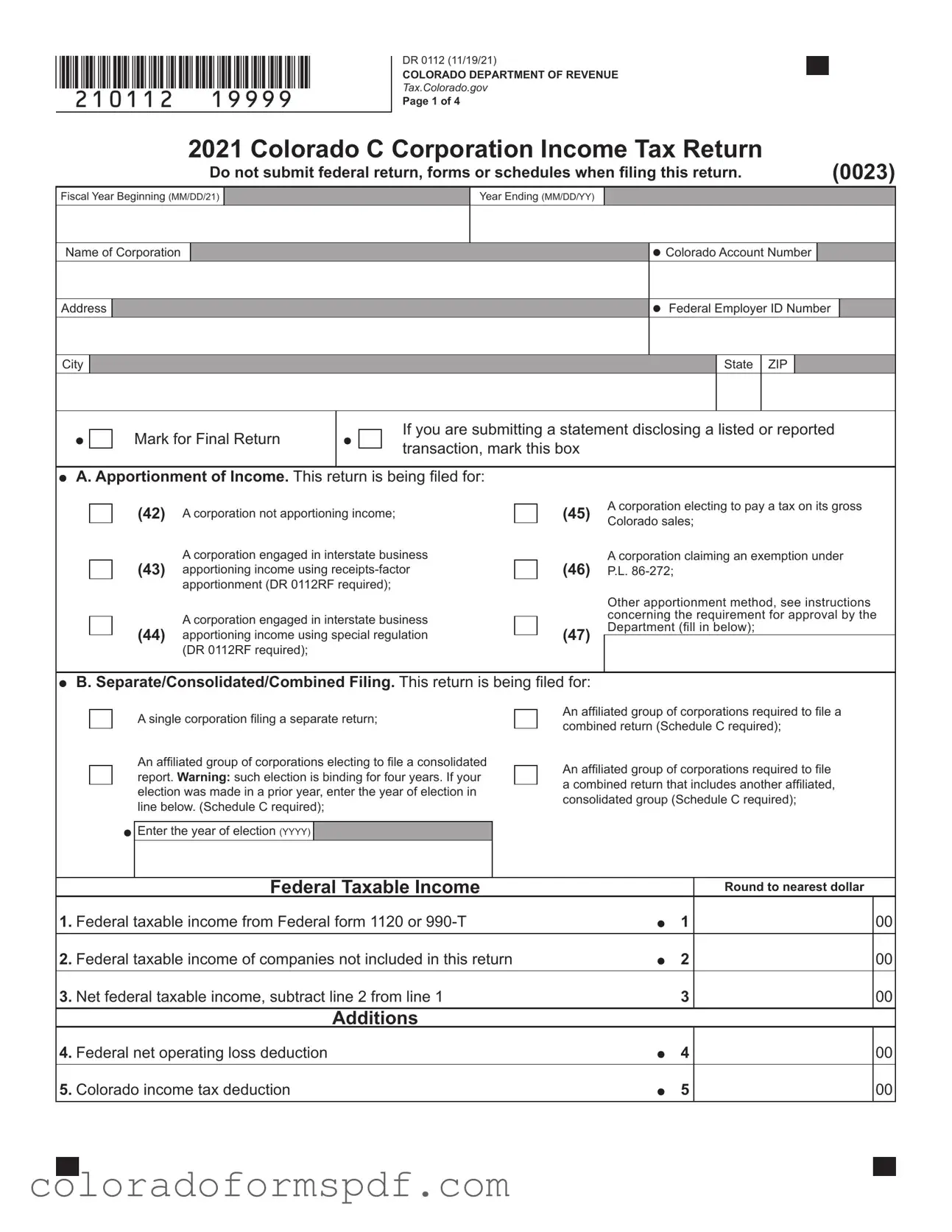

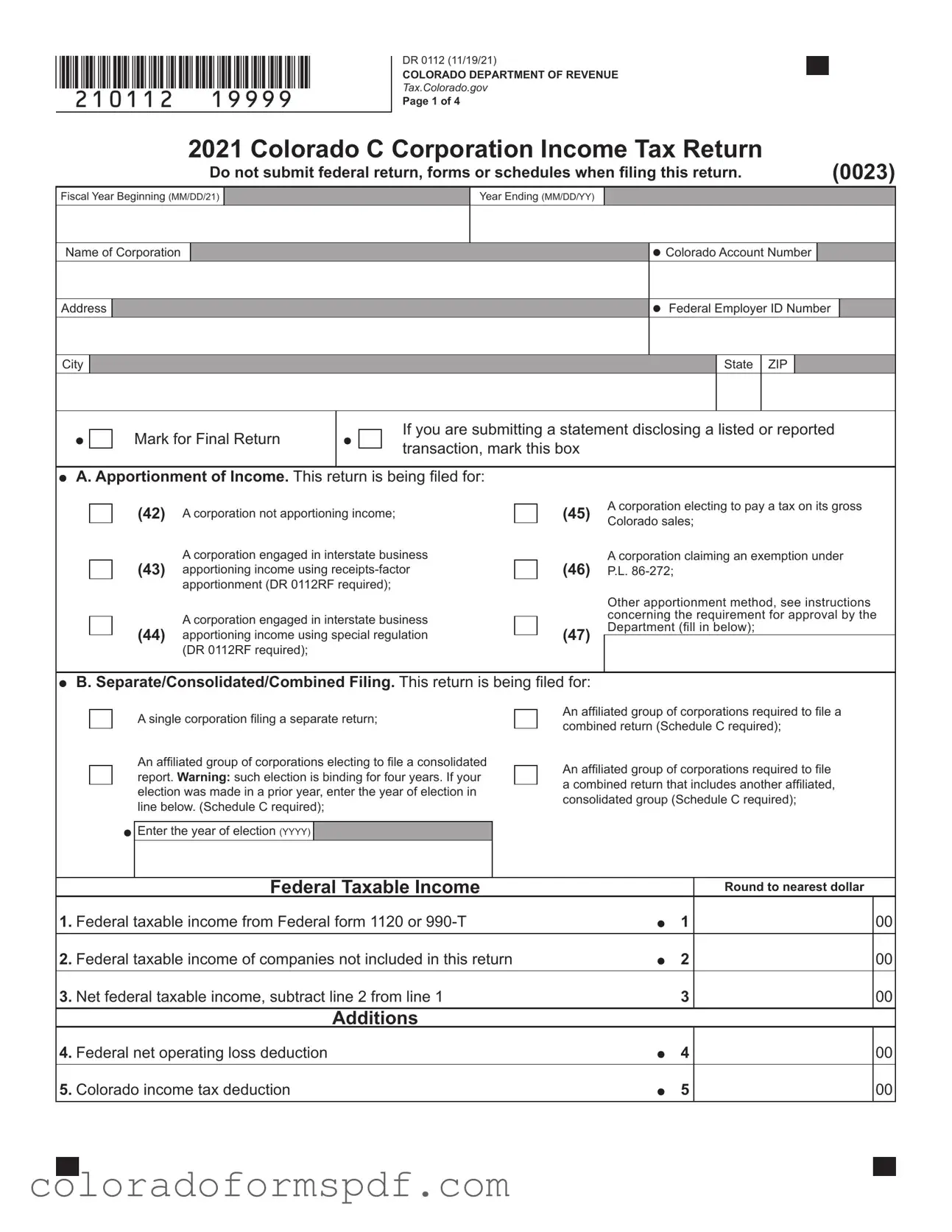

Get Colorado 112 Form

The Colorado 112 form is a crucial document used for filing income tax returns for C Corporations in Colorado. This form includes various schedules and instructions necessary for accurate reporting and payment. Understanding its components and requirements can help ensure compliance and avoid penalties.

Get Document Online

Get Colorado 112 Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Colorado 112 online, then download.