Get Colorado 104Pn Form

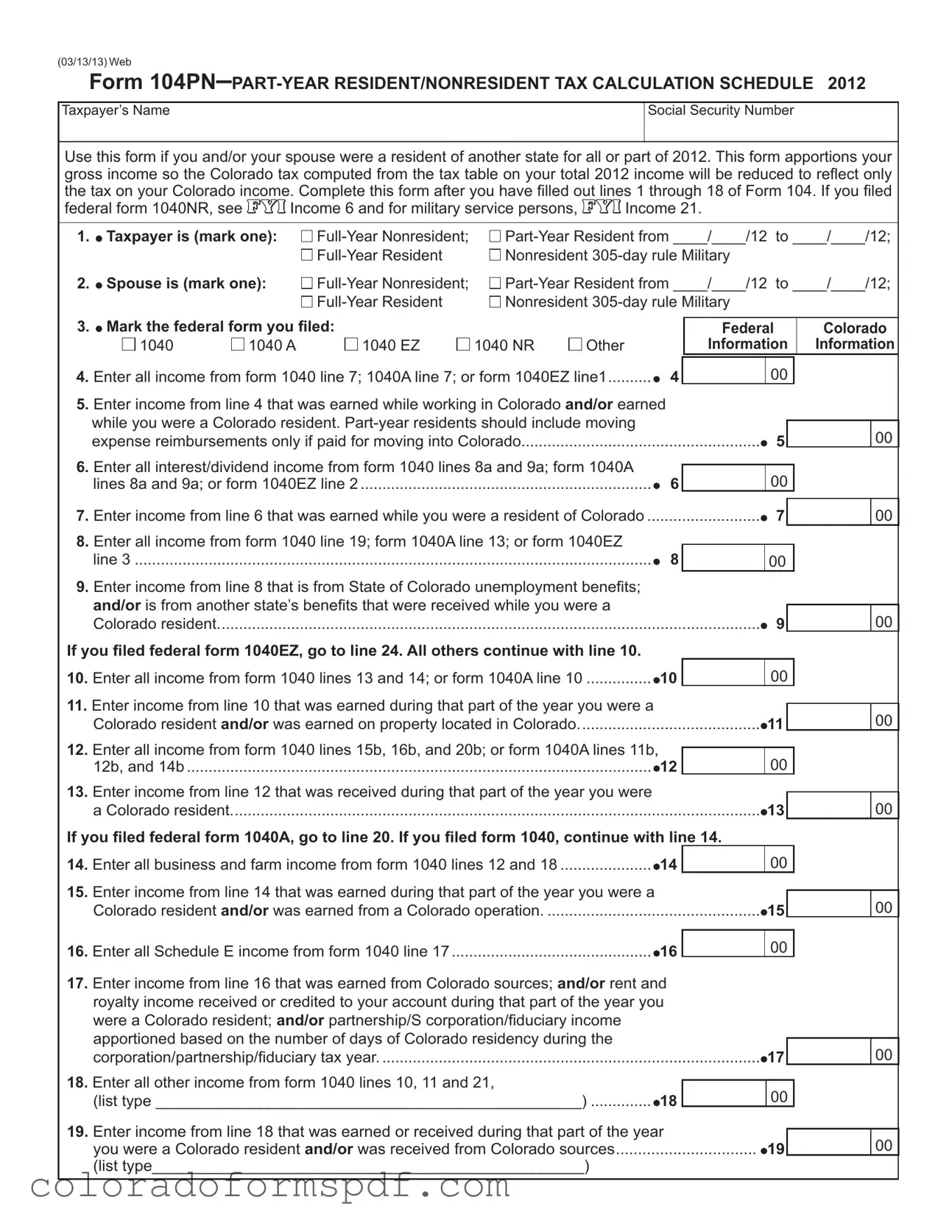

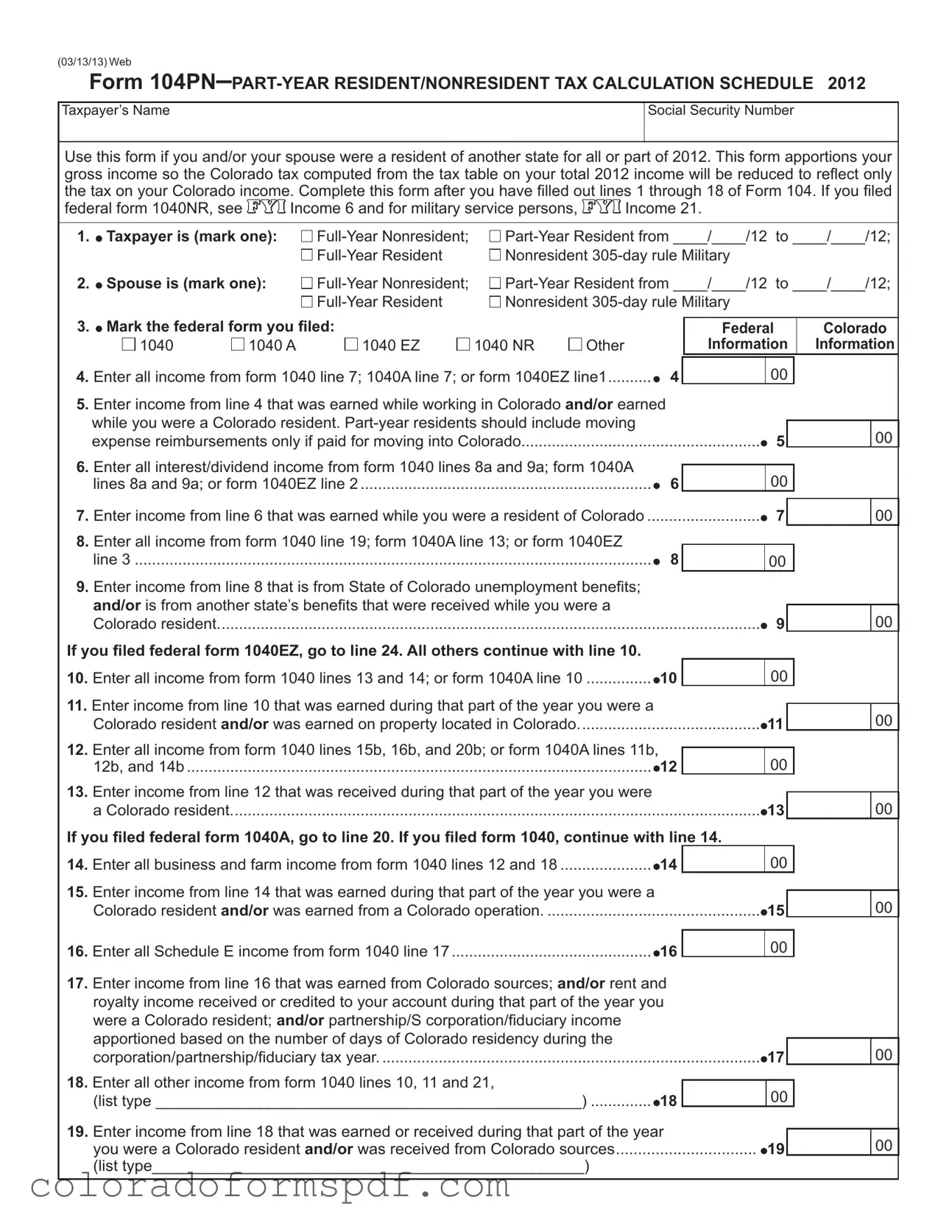

The Colorado 104PN form is a tax calculation schedule designed for part-year residents and nonresidents who earned income while living or working in Colorado. This form helps to fairly apportion your gross income, ensuring that the Colorado tax you pay reflects only the income earned within the state. By completing this form, you can accurately determine your tax liability based on your Colorado income for the year.

Get Document Online

Get Colorado 104Pn Form

Get Document Online

Get Document Online

or

Download PDF

Quick form completion starts here

Edit and finish your Colorado 104Pn online, then download.